Sample Financial Plan: Steve and Amanda Doe's Example Financial Plan

May 16, 2024

It's a great privilege for us at Peak Financial Planning to share an example financial plan with you. We'd like to give you an idea of what the process looks like when working with us to build your financial plan.

When done right, the financial planning process will be something you only experience 1 time in your life (if you have to do it a second time, the first plan has failed...). This makes it difficult to visualize or relate to.

We will be using Steve and Amanda Doe (Fictional characters) as examples in this sample financial plan. Bear in mind that all financial plans are unique - what you see below are only a selection of the reports and data points that might be included in one's financial plan.

This written piece and accompanying video guide will illustrate the data points we will collect, how we address client goals, the types of reports and models we use to convey information, and ultimately how the partnership between you - the client - and we - the advisor - functions.

All account values and investment returns in the "Doe's" example financial plan are based on historic market performance and do not necessarily reflect future market returns.

It is important to note that a financial plan is not a static document that you receive, like a car fax on your car. It is a dynamic, ongoing, iterative process that is routinely updated. It is a combination of financial models along with a relationship with a financial advisor that, when combined, provide a roadmap to reach your dynamic financial goals. If you would like some assistance auditing your financial goals - click here to schedule a free no obligation consultation .

With that out of the way, let's dive into our personal financial plan samples.

Table of Contents

The initial consultation, the financial planning process, gathering documents.

- Setting Up the Software Tools

Reviewing Your Personal Financial Plan Recommendations

The investment plan, the income plan, the tax plan, the estate plan, implementing your personal financial plan - building your "financial house", the ongoing financial planning relationship - "maintaining your financial house", choosing a financial planner.

Steve and Amanda Doe have gone through life as most of us do. Following the general guidelines without too much consideration of how to adapt those to their personal life. They have a spiderweb of investment accounts, bank accounts, and credit cards. They know roughly what they spend each month. They are comfortable speaking to each other about their finances, but rarely do as they do not have significant consumer debt and therefore don't feel like they are doing anything wrong.

One day scrolling through Facebook or Tik Tok, they came upon a video talking about the " Retirement Risk Zone " - a transitional phase in most people's financial lives where they have significant financial decisions to make that have ramifications for the rest of their lives. After watching the video together, they decided it was time to recruit the help of a financial advisor.

After speaking to friends and family and doing a bit of internet research, they arrived at a list of requirements for any financial professional they would consider working with.

1) The financial advisor needs to be "Fee Only". This means that the firm does not receive any commissions, sales related compensations, or referral compensation . The firm will only ever be paid DIRECTLY by the Doe's. This would effectively limit the conflicts of interest the firm might face.

2) The financial advisor needs to be a "Fiduciary". Acting as a fiduciary means that the firm is obligated to act in the client's best interest when making financial recommendations. To obtain "fiduciary" status, the firm must be Fee Only and meet rigorous regulatory requirements.

3) The Advisor must at a minimum be a CERTIFIED FINANCIAL PLANNER PROFESSIONAL . This would ensure that the practitioner would have the training, skill, and experience to support their financial plan.

Peak Financial Planning Advisors are Fee Only Fiduciaries and CERTIFIED FINANCIAL PLANNER PROFESSIONALS. Use this link to schedule a free consultation with us to learn more about working with our fee only, fiduciary financial advising team to build your financial plan.

With the above criteria in mind, the Doe's scheduled an initial consultation with Peak Financial Planning.

The Doe's completed a "Financial Fact Finder" in advance of their initial meeting with PFP. Completing the fact finder was the first time they aggregated their financial picture into one place and proved to be a highly informative exercise. Having the data from the fact finder assisted their PFP advisor in assembling a list of questions that should be asked in advance of the financial planning process.

During the 1-hour, free consultation, PFP explained their business structure, their flat fee system, how they handle wealth management relationships , and what the financial planning process would look like . Their PFP advisor took them for a test drive in the financial planning tool - RightCapital - and reviewed a mock Client Agreement with them. Steve and Amanda were reassured to have an exact dollar amount of the fees , a timeline of the process, clear expectations of their time commitment, and an understanding of the guidance they would receive from their financial plan.

Steve and Amanda felt safe and comfortable with PFP's approach to financial planning and investment management and decided to move forward with the relationship.

Steve and Amanda's PFP advisor explained it would be helpful to think of the PFP Financial Planning process as three distinct phases.

Phase 1 - The audit of the Doe's financial position.

This phase would consist of 3-4 90-minute meetings over the course of 4-6 weeks.

The PFP team would use these meetings to assess, diagnose, and present the Doe's financial planning recommendations. Upon Steve, Amanda, and their PFP advisor coming to a consensus on the financial course of action, they would then move into phase 2.

Phase 2 - The implementation of the initial financial recommendations.

Their PFP advisor explained that phase 2 could take anywhere from 6 weeks to 6 months to complete, depending on the speed at which the team (Steve, Amanda, and their PFP Advisor) could execute. This phase would consist of a series of 30-minute "implementation" sessions where Steve, Amanda, and their advisor would get together to complete the actions outlined in their financial plan.

This phase is best visualized as the "building of the financial house". During this phase the ground is cleared, the foundation laid, the scaffolding put up, the roof put on. By the end of the implementation phase the Doe's financial house will be complete, and ready to move on to phase 3.

Phase 3 - The ongoing relationship: monitoring, and maintenance.

Steve and Amanda's PFP advisor explained that their financial plan is a living, breathing entity. It's dynamic and constantly responding to changes in their life's circumstances. Their PFP advisor explained that in phase 3 they enter PFP's ongoing financial planning process. They will meet their PFP advisor a minimum of 4 times per year to review, update, and execute on the pillars of their financial plan (described below).

Steve and Amanda are reassured to hear that they can reach out to their PFP advisor at any time throughout the year to schedule additional time ( at no additional cost ) by phone, zoom, or in person should their financial circumstances change.

Looking for a Fee Only Fiduciary Certified Financial Planner Professional to help you achieve your financial goals? Click here to schedule a free no obligation consultation .

The Data Gather Process - The Financial "Assesment"

Upon formalizing the financial planning relationship with PFP, Steve and Amanda were walked through the firm's formal data gather process. Their PFP advisor walked through:

1) How to set up RightCapital (Financial Planning Software).

2) Which documents on the Document Gather Checklist the Doe's should provide.

3) How to securely share documents with their PFP Advisor.

4) How to locate screenshare support videos explaining the above should the Doe's need additional support.

The Doe's provided:

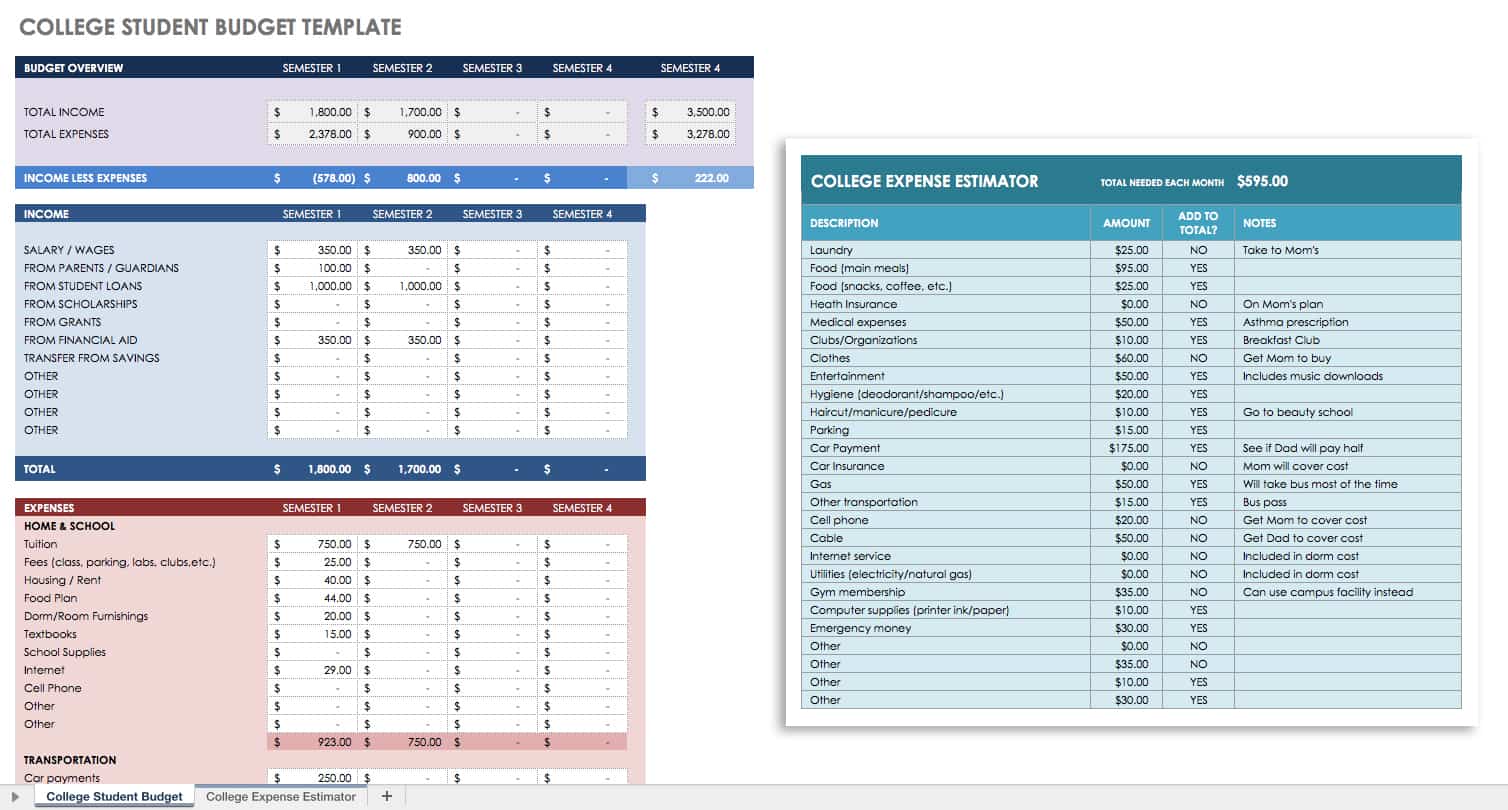

- A budget worksheet (template provided by PFP)

- Tax returns

- Account statements (mortgages, investment accounts, bank accounts)

- Life insurance policies

- Social security statements

- Wills, and other estate planning documents (trusts, HPOA, medical directives).

These documents were uploaded to a secure file vault within the RightCapital planning tool for their PFP advisor to review.

Setting Up Software Tools

RightCapital provides a comprehensive financial dashboard. It would allow Steve and Amanda to aggregate their full financial picture into one place so that they do not need to house that information in their heads (and hope they do not forget details!).

Using the walkthrough video provided by their PFP advisor, they linked their bank accounts, investment accounts, credit cards, mortgage loan, car loans, and investment property value to RightCapital.

This will allow both Steve and Amanda as well as their PFP advisor to see real time updated balances for all their accounts in one place, saving a tremendous amount of time in future meetings by eliminating the need to play "account balance catch up".

The Data Gather Meeting

Behind the scenes, Steve and Amanda's PFP advisor performed an exhaustive audit of their financial position. The product of this audit was a list of tens of questions that needed answering from Steve and Amanda before their PFP advisor could proceed with constructing their personal financial plan.

During the Data Gather meeting, Steve and Amanda proceeded to answer their PFP advisors' questions. They discussed Steve and Amanda's goals:

1) They both want to retire in the same calendar year - when Steve turns 65 and Amanda turns 61

2) They want to have a $12,000 per year travel budget for the first 10 years of their retirement, with the option for a $12,000 travel budget for their entire retirement health and physical condition permitting.

3) They want to identify the maximum spending tolerance of their financial assets, not necessarily to spend it, but simply to understand what their boundaries and limitations might be.

4) They want to know if there is anything they can do to retire earlier then age 65 and 61.

Having a clearer picture of the Doe's financial situation and an understanding of their future goals, they scheduled their "Financial Plan Proposal" meeting.

Their PFP advisor set to work constructing their personal financial plans.

The Financial Plan Proposal - The Financial "Diagnosis"

The CFP® professional at PFP added all of the Doe's personal finances into RightCapital.

The PFP advisor created the Doe's baseline example financial plan. The baseline plan shows whether or not the Doe's would be able to achieve their stated goals if they were to change NOTHING about their current financial behaviors. The baseline plan is used for comparison purposes so that the PFP advisor can show the effects of their financial recommendations against the Doe's current actions.

With the baseline plan complete, the PFP advisor then created a comprehensive list of all of the Doe's possible financial action items.

With the list of recommendations complete, Steve, Amanda, and their PFP advisor sat down to discuss the recommendations.

Their PFP advisor stressed that there is no perfect financial plan. Often times the plan that is the best "numeric" plan is actually not one that most people will execute on. It requires too much sacrifice, too many difficult tradeoffs.

The Doe's baseline financial plan example showed a probability of success of 66%. This indicated that as things currently stand, if no changes are implemented, there is too much risk of them being unable to meet their financial goals.

Their PFP advisor explained that they like to see a plan success rate between 75% - 90%. Under 75% and there is too much risk of failure. Over 90% and the client is not being ambitious enough with their spending goals. That being said, there are always exceptions to these guidelines that are discussed on a case by case basis.

Over the course of the 90-minute meeting Steve, Amanda, and their PFP advisor discussed each of the plan recommendations in detail. They discussed the tradeoffs of each item - some would cost time, some would cost money, and some would mean sacrifices in either current spending or desired future spending.

Steve and Amanda felt comfortable with the 8 recommendations their PFP advisor presented them. On the spot, their PFP advisor showed them 2 plan scenarios - one scenario where 5 of the 8 recommendations were implemented, and another scenario where all 8 of the recommendations were to be implemented.

In the first scenario (with 5 of the recommendations implemented), Steve and Amanda's probability of success went from 66% to 71%. At their PFP advisors recommendation, they adjusted that scenario slightly to reduce the Doe's annual pre-retirement spending by $400/month, resulting in a success rate increase to 74%! Steve and Amanda were surprised at how sensitive the plan was to spending and made a mental note to think further on that.

In the second scenario (with all 8 of the recommendations implemented), the probability of success went to a whopping 82%. In addition, their PFP advisor demonstrated how, by executing on the additional 3 recommendations Steve and Amanda would not need to reduce retirement spending and still maintain the 82% success rate.

To be thorough, the Doe's PFP advisor ran them through some additional scenarios showing them how working longer, reducing spending, and increasing savings might improve their plan success rate.

After talking through things, the Doe's were comfortable with proceeding with plan scenario 2 (with the 8 recommendations) with an understanding that they could adjust course as they approach their retirement age.

Looking for a Fee Only Fiduciary Certified Financial Planner Professional to help you achieve your financial goals? Click here to schedule a free no obligation consultation.

The Financial Plan Presentation - Receiving your Financial "Prescription"

Incorporating the feedback from their prior meeting, Steve and Amanda's PFP advisor arrived at their Plan Presentation meeting with a final presentation of their financial plan. Their PFP advisor explained that their plan would be broken down into 5 "micro" plans: A Cash Flow plan, an Income plan, an Investment plan, a Tax plan, and an Estate plan.

The Cash Flow Plan

Because a financial plan is a hypothetical model, it is critically important that the inputs into that model are as accurate as possible. Cash flow, or spending habits, are the foundation upon which good financial plans are built. If estimates of spending are off by a significant margin, all of the downstream recommendations fall apart.

Steve and Amanda's PFP advisor recommended implementing a two-part cash flow system:

1) A bookkeeping system to monitor income and spending to start ASAP. This system would allow the Doe's to get in touch with their spending habits which would be beneficial for several reason. First, it would verify that the budget worksheet the Doe's provided is accurate, and that the spending data in the plan is accurate. Second, it would help the Doe's visualize their desired retirement spending so they could make informed decisions about what to keep, what to cut, what's negotiable, and what's non negotiable when it comes time to retire. Third, it would allow the Doe's to course correct quickly were their income or expenses to change suddenly.

2) A slush fund system to help provide savings cushions for annual expenses, one time purchases, and surprises. The slush fund system is a series of emergency funds that account for surprise areas of spending that PFP advisors find clients do not account for.

Based on their estimated spending in retirement, Steve and Amanda's PFP advisor recommended that they need to achieve a 22%-25% savings rate each year until retirement. Steve and Amanda are currently saving 17% of their annual income. With their bookkeeping and slush funds system in place, both thought it possible to increase their savings rate to the desired range.

Steve and Amanda's PFP advisor explained that the income plan is the strategy of identifying how much income they will need to cover their desired level of spending in retirement.

The Required Portfolio Income formula is quite simple. It is:

Desired Spending - Guaranteed Income = Required Portfolio Income

Because Amanda and Steve have the retirement savings to support it, as well as being in excellent health with potentially longer than average lifespans, their PFP advisor recommended that they defer claiming Social Security until Steve's age 70, Amanda's age 66 in order to capture the largest guaranteed benefit.

Using their social security benefit estimates (found on their social security statements), Steve and Amanda's PFP advisor identified their portfolio income requirement. Their advisor explained that each year as they neared retirement, they would review their savings, cash flow, and investment performance in order to make adjustments to the income plan.

Steve and Amanda's PFP advisor explained that their Investment plan is constructed to support their income plan. In order to achieve their desired level of spending in retirement, they would need to achieve a roughly 7.5% rate of return on their portfolio assets. As their portfolio was currently constructed, they were achieving a 6.4% rate of return.

Steve and Amanda's PFP advisor recommended shifting away from a strategic asset allocation relying on vague numbers such as a “60%/40% portfolio” towards a tactical asset allocation that would both produce better growth and provide greater capital preservation .

Regarding their actual investment selection, Steve and Amanda's PFP advisor recommended adjusting their investment selection to reduce high mutual fund fees (1.45% average) and replace them with low fee exchange traded funds (.08%-.15%), some directly held stocks (no fees), and some directly held bonds (no fee's).

Their PFP advisor also explained that their investment strategy would adjust based on changes to the economic environment and technical market conditions.

Steve and Amanda's PFP advisor explained that outside of savings rate, taxes have the largest impact on ones financial life.

The Doe's PFP advisor recommended that they execute on two actions for their tax planning process.

The first - that both Steve and Amanda shift their contributions from ROTH 401k accounts and into traditional 401k accounts. This would save them roughly $15,000 per year in income taxes.

The second - that the Doe's execute a ROTH conversion strategy over the course of their retirement that, executed properly, would result in roughly $1,300,000 more tax adjusted ending portfolio assets.

In addition, given their wealth, it appears likely that the Doe's would be leaving sizable assets to their heirs. Steve and Amanda's PFP advisor explained that ROTH conversions help position their assets into more tax favorable buckets so that their heirs are not hit with huge tax burdens as a result of their inheritance.

Steve and Amanda had recently had their will and trust updated in advance of beginning work with Peak Financial Planning.

After reviewing their estate documents, their PFP advisor had no urgent recommendations to take action on.

They set up reminders to do annual reviews of the Doe's retirement account beneficiaries, as well as bi-annual reviews of their will and trust documents so as not to let those fall through the cracks.

With the financial plan presented and agreed upon, Steve and Amanda moved into the implementation phase.

Their advisor had added all the action items to the project management dashboard of the financial planning tool, RightCapital in advance.

Together, the three of them went through the list of recommendations. They created tasks, set deadlines, and scheduled three 30-minute implementation meetings during which to complete those tasks. Lastly, their PFP advisor provided them a list of the additional documentation that would be required to complete those tasks.

Their advisor explained that the Doe's would receive regular email reminders about tasks assigned to them as well as a regular "digest" of the tasks accomplished during the prior week. This would keep the Doe's up to date about what their advisor might be doing on their behalf behind the scenes, such as opening new accounts, completing investment account transfers , updating beneficiaries, making investment model adjustments, etc.

Peak Financial Planning, as a wealth management firm, would execute the implementation of the investment and tax portions of the Doe's financial plan.

PFP handled all of the paperwork to move the Doe's taxable and retirement accounts to be managed at their broker and custodian, Charles Schwab.

PFP coordinated with the Doe's CPA to navigate the tax implications of the recommended portfolio reallocations.

After the financial plan was built and implemented, the Doe's had an ongoing financial planning and wealth management relationship with PFP.

The Doe's PFP advisor explained that the ongoing relationship would be organized around 5 pillars.

- To ensure savings targets are met (pre-retirement)

- To ensure portfolio drawdown rate is not exceeded (in retirement)

- Performing their recommended ROTH conversions in the right years and in the right amounts

- Performing investment management in response to economic/technical changes in the financial markets

- Performing investment management in response to changes in employment, health, or family circumstances.

- Performing regular portfolio rebalancing, tax loss harvesting, investing new funds, and providing liquidity for short/intermediate term funding goals.

- Liquidating the appropriate investments

- Drawing the right dollar amount from the right accounts

- Managing the tax liabilities as a result of constructing portfolio income

The Doe's were comforted by having clear, predictable direction each year into and after retirement. They felt reassured to know that all their financial and investment advice needs would be serviced under one roof, for one comprehensive fee.

The Doe's PFP advisor explained that the PFP policy is to hold a minimum of 4 meetings per year with each ongoing client to ensure that they feel educated and connected to their retirement plan . Their advisor explained that there is no additional cost or mounting fees if the Doe's were to request additional time via meetings, phone calls, or emails.

The Doe's found that the ongoing relationship, team oriented, client first approach of Peak Financial Planning helps them sleep well at night knowing they have a true financial partner in their camp.

If you’d like to review some additional personal financial plan examples, please refer to our Youtube channel as well as the Case Studies section of our website.

Frequently Asked Questions

How long does the financial planning process take.

Financial Planning is an ongoing dynamic relationship between you and your financial planner . The process can be broken into three phases:

Phase 1: Onboarding - which usually takes 4-6 weeks.

Phase 2: Implementation - which can take between 6 weeks and 6 months depending on circumstances.

Phase 3: Ongoing Maintenance & Monitoring - which lasts for life!

What does the Financial Planning process cost?

Peak Financial Planning advisors are Fee Only, Fiduciary, Flat Fee advisors. We charge a $5,000 flat fee for the construction and year 1 implementation of your financial plan. In year 2 onwards we charge an ongoing flat fee of $416.67/month OR 1% of the value of the assets we directly manage. Send us a message for more details or view our pricing page here .

Where can I see a Financial Plan example?

You can view a printable financial plan example here .

Or you can watch this YouTube video for some additional financial plan examples.

Will a Retirement Plan help with financial stability?

Financial stability is a product of planning and education. The process of building a retirement plan will improve financial literacy, increase your financial education, create a feeling of confidence, and overall improve your odds of achieving financial freedom.

Why you should review financial plan examples.

Making changes to your investment or retirement strategy are extremely high risk, high consequence decisions. Before you make hasty adjustments to your plan, it’s critical that you review financial plan examples or case studies that the professional helping you has created. You want to make sure that that professional has the expertise and experience required to guide you successfully to your financial goals.

The 4 Step System To Living Your Dream Retirement - FREE Webinar

Peak Financial Planning is a Registered Investment Advisor in the State of CA

.webp)

Learn to Build a 5-Year Retirement Plan With Our FREE Video Series

.webp)

Free Financial Planning Templates

By Andy Marker | September 21, 2017

- Share on Facebook

- Share on LinkedIn

Link copied

Whether you’re starting a business or looking for ways to grow an existing company, creating and following a financial plan can help ensure success. An effective plan can inform business decisions, provide documentation for investors and other stakeholders, and serve as a guide to help you reach objectives. Some businesses may choose to work with financial consultants or use software to manage financials, but for some teams, templates offer an easy method to begin strategic planning. Below, you’ll find multiple free financial planning templates for both business and personal use.

These free templates are designed for users with a wide range of experience levels, and offer professional quality along with simplicity. You’ll find templates for goal planning, financial projections, budget planning, retirement calculations, and more.

Business Financial Planning Templates

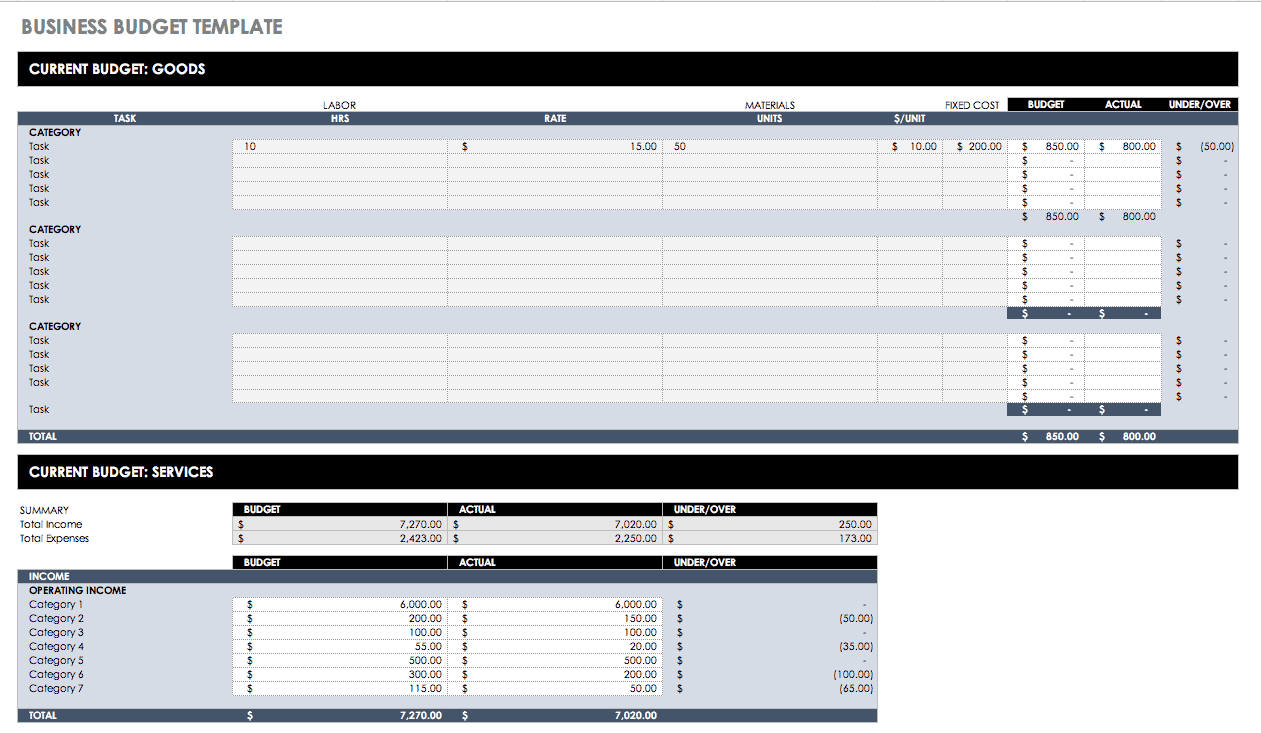

Business budget template - excel.

Download Business Budget Template

Excel | Smartsheet

This business budget template provides a mix of detailed spreadsheets and graphical data reports. You can estimate expenses, track actual expenditures, and view variances, all of which are summarized by month and visually represented in charts. This information allows you to create a comprehensive business financial plan template.

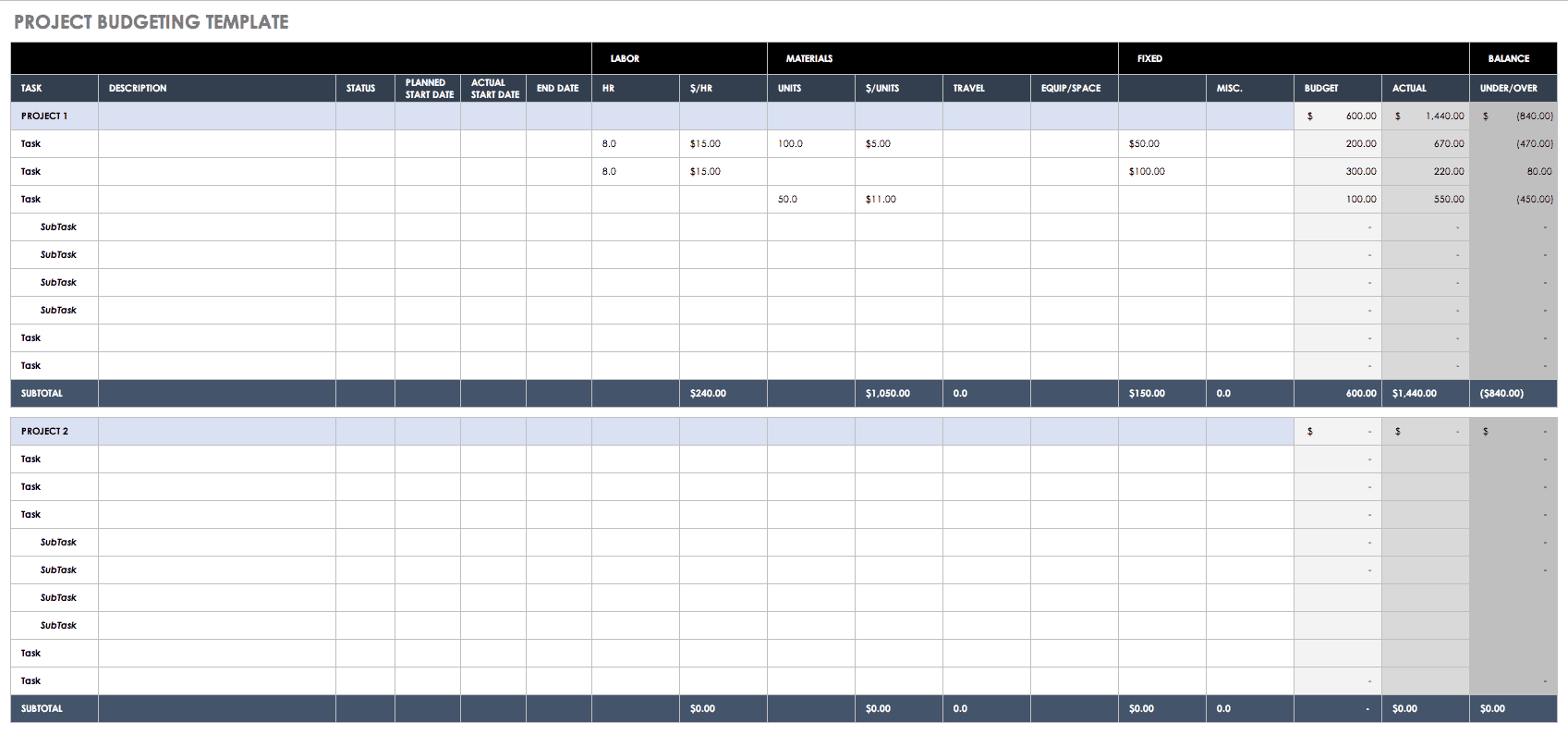

Project Budget Template - Excel

Download Project Budget Template

Designed for projects, this template allows you to list costs for each task. Depending on the type of project, you may include hourly services that contract employees provide, equipment costs, or other expenses. Create an estimated budget and then compare actual expenses to help with financial planning on future projects.

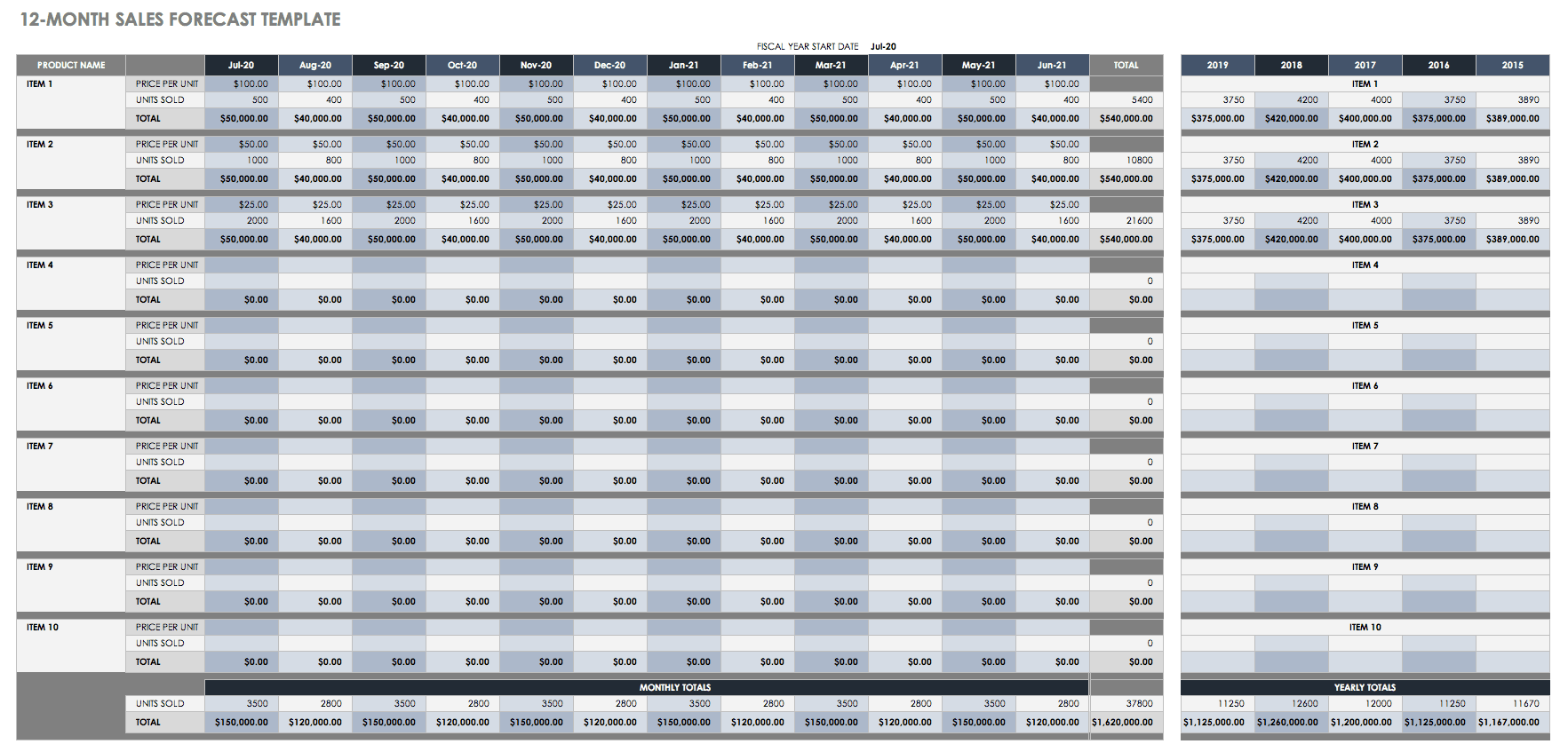

12-Month Sales Forecast Template - Excel

Download 12-Month Sales Forecast Template

Use this sales forecast template to create financial projections for individual products on a monthly and annual basis. You can also track sales performance over time and compare figures from previous years. Color-coded cells make it easy to view data for each month, and the template calculates monthly and annual totals.

Event Budget Template - Excel

Download Event Budget Template

Whether you’re planning a conference, company party, fundraiser, or wedding, any tool that helps organize your event planning process can reduce stress and aid in creating a successful event. This budget template lists the many expenses involved in an event, from venue rentals to programming and advertising. It also compiles the data you enter into visual charts so that you can quickly get an idea of your event budget allocation.

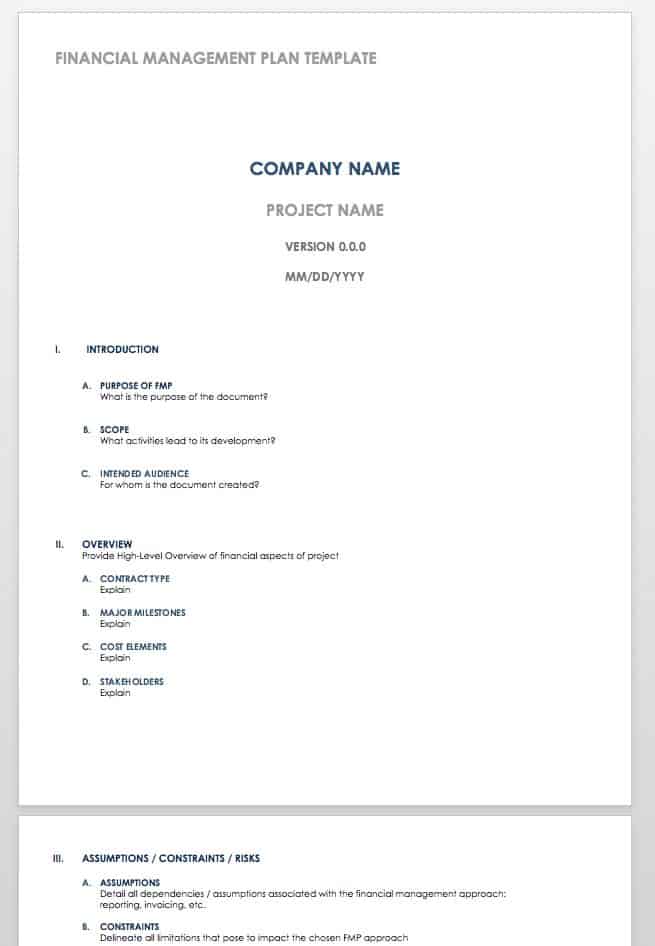

Financial Management Plan - Word

Download Financial Management Plan

Word | Smartsheet

Create a financial strategic action plan with this Word template. You’ll find a basic outline to follow, including sections for an overview of your business or project, assumptions, risks, financial management methods, and more. Once you have created a comprehensive financial plan, use it as a living document, just like you would a business plan. You should review and update financial templates regularly in order to assess progress, provide accountability and accuracy, and ensure that it continues to meet your needs.

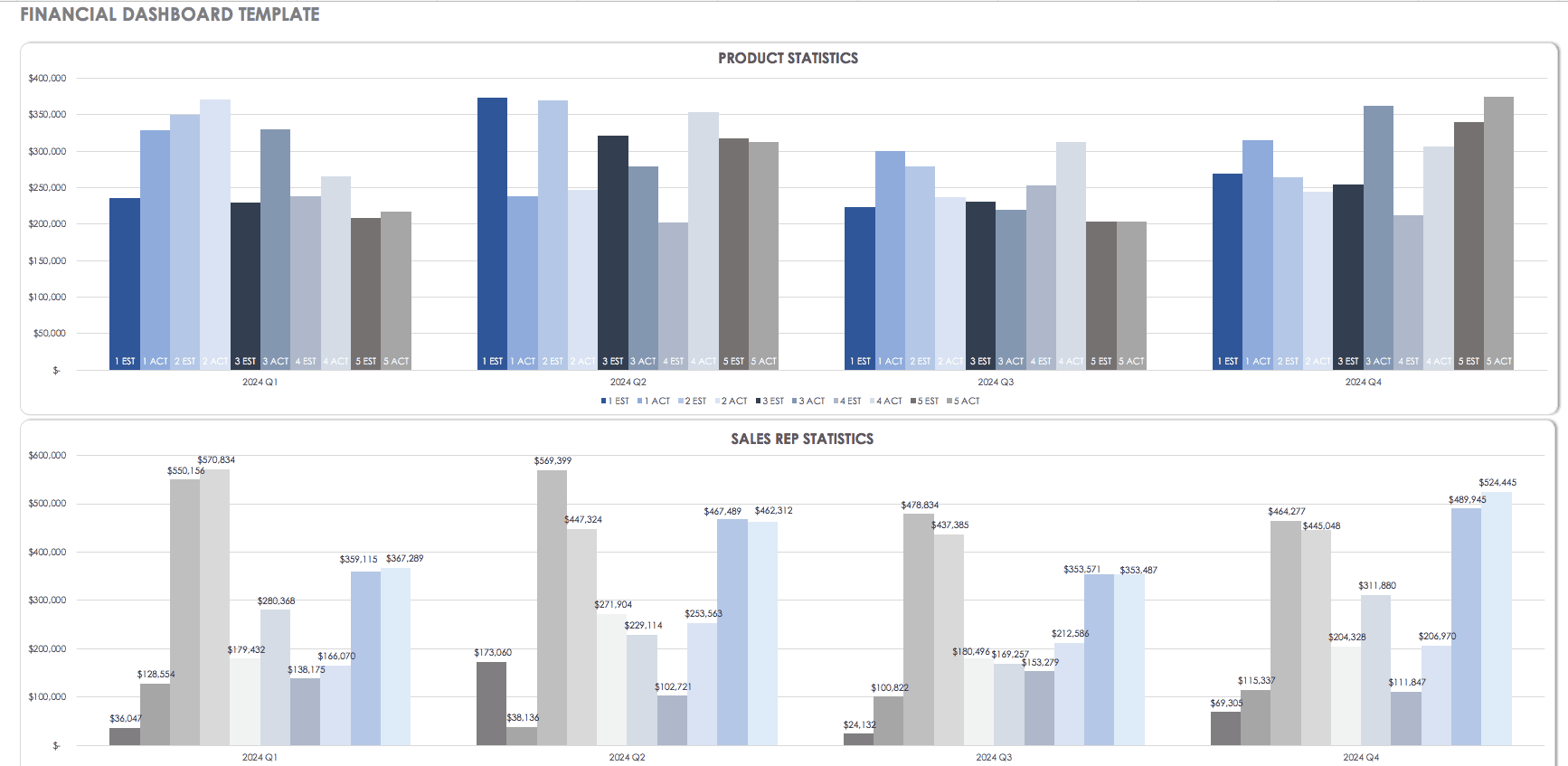

Financial Dashboard Template - Excel

Download Financial Dashboard Template - Excel

This template provides a summary report of financial data with a dashboard view, which makes it easy to compile and quickly review information. You’ll get a combination of bar charts, a pie chart, and a graph to compare statistics over time. Use the template to measure product performance, view sales data, and chart annual revenues or other financial information.

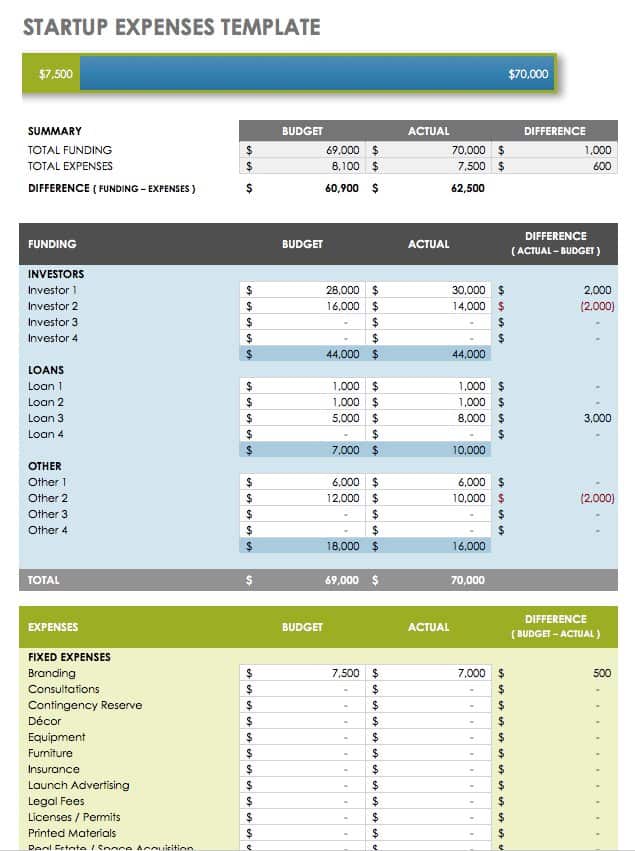

Startup Expenses Template - Excel

Download Startup Expenses Template - Excel

If you’re starting a business, this template can help you identify potential funding sources as well as necessary expenses to get your venture up and running. Similar to a budget template, you can track both estimated and actual costs, and make adjustments as needed. Identifying startup expenses can support your business planning process and help ensure that you have adequate financial resources to reach your goals.

Break-Even Analysis Template - Excel

Download Break-Even Analysis Template

A break-even analysis shows when a business will meet all of its expenses and begin to reach financial profitability. To do this analysis, enter your fixed and variable expenses into the template and the pre-set formulas will calculate how much revenue a business needs to break even.

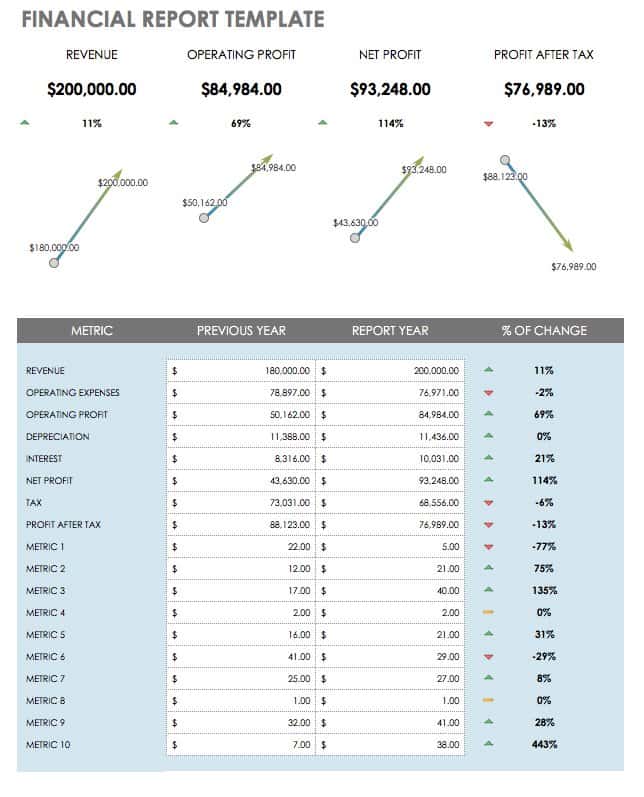

Financial Report Template - Excel

Download Financial Report Template

Create an annual financial report for your business that shows key metrics in an easy-to-read format. Getting a financial overview allows you to track performance over a given time period, and a summary report simplifies communication with stakeholders. You can easily print and share this Excel template as a PDF document.

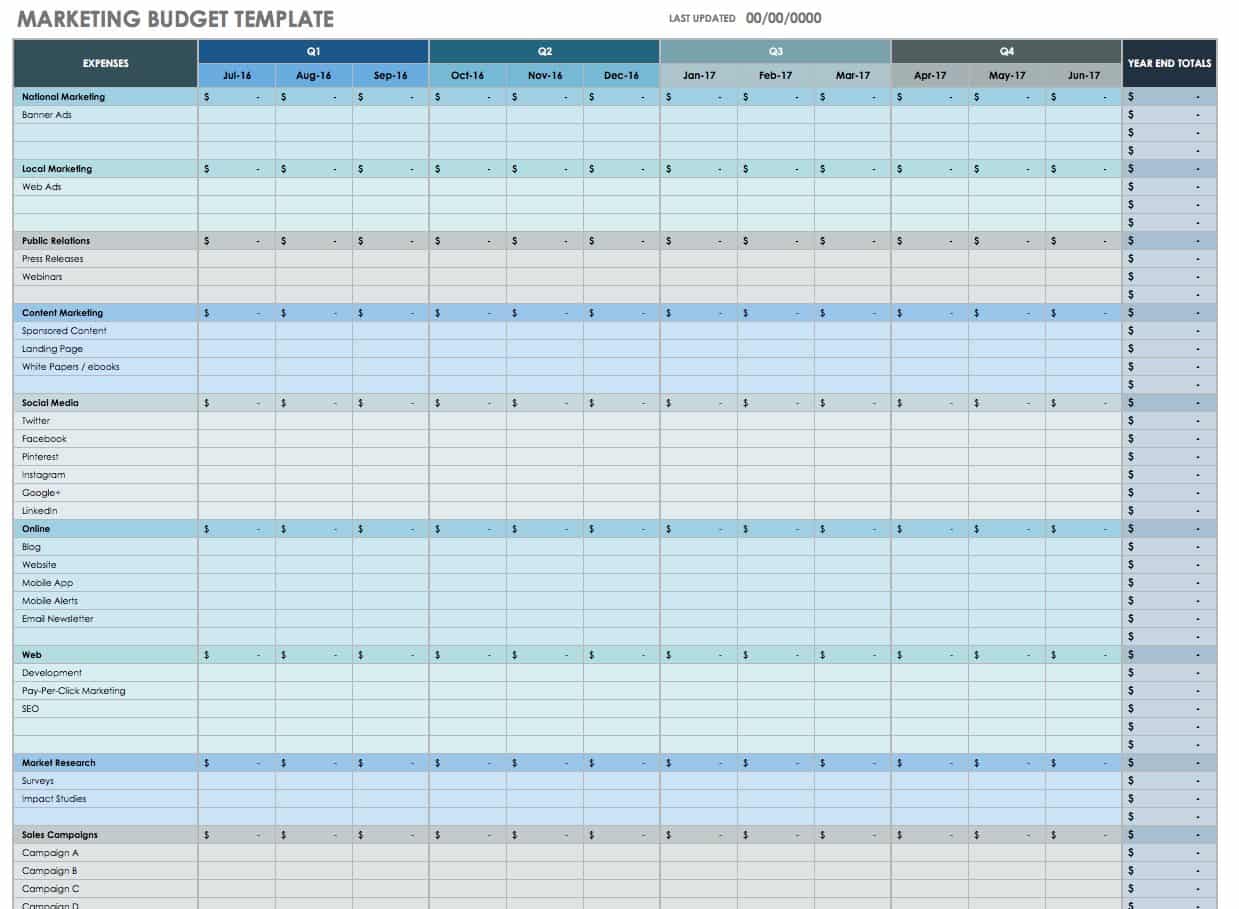

Marketing Budget Template - Excel

Download Marketing Budget Template - Excel

Create a comprehensive marketing budget plan with monthly, quarterly, and annual views on one template. In the first column, you’ll find a list of marketing expenses that include public relations, social media, advertising, online content, and more. There is also a section for listing specific marketing campaigns so that you can estimate and compare costs for each.

Personal Financial Planning Templates

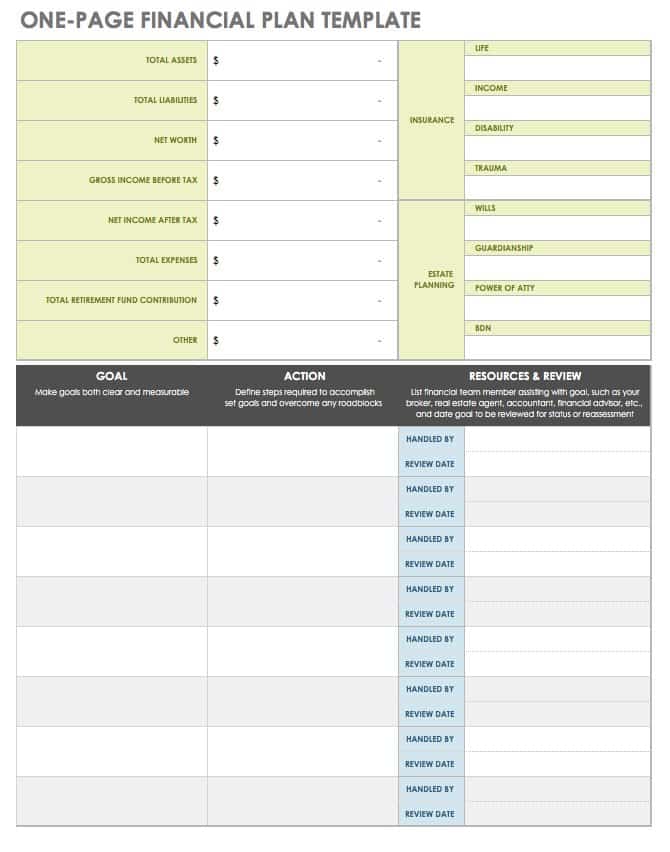

One-page financial plan template.

Download One-Page Financial Plan Template

Excel | PDF

Individuals can also benefit from strategic financial plans. This one-page template allows you to create a personal financial plan that is concise yet comprehensive. Determine your current financial situation, create an action plan for reaching goals, and use the plan to track implementation and progress. If needed, you can include numbers for life insurance or estate planning.

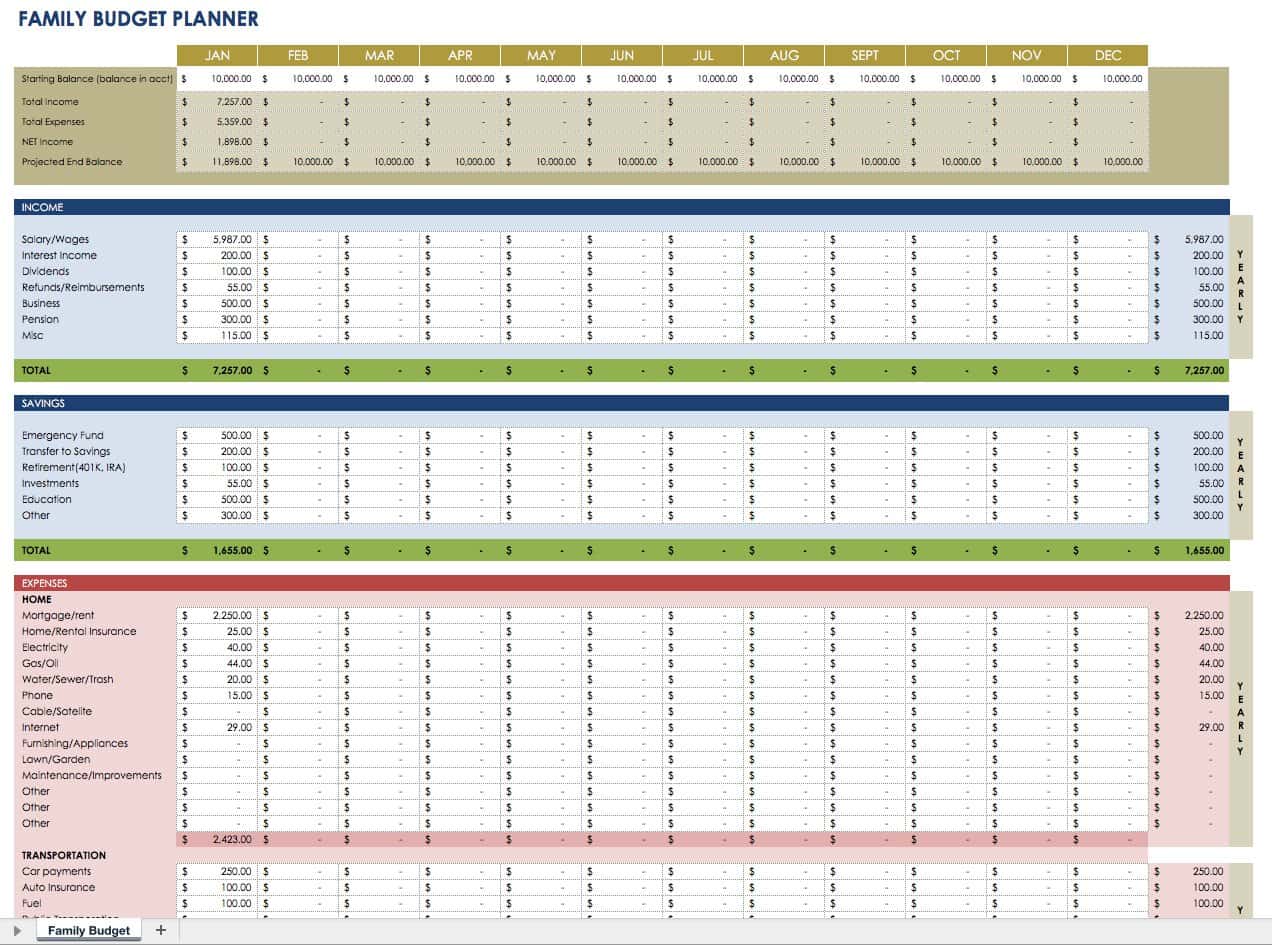

Family Budget Planner Template - Excel

Download Family Budget Planner Template - Excel

Families can use this planner to track household expenses and create a monthly balanced budget. You’ll find a list of common expenses including housing, transportation, healthcare, and entertainment, but you can also edit these categories to align with your specific monthly costs. The template also includes a section for savings to help you plan for retirement, create an emergency fund, and track investments.

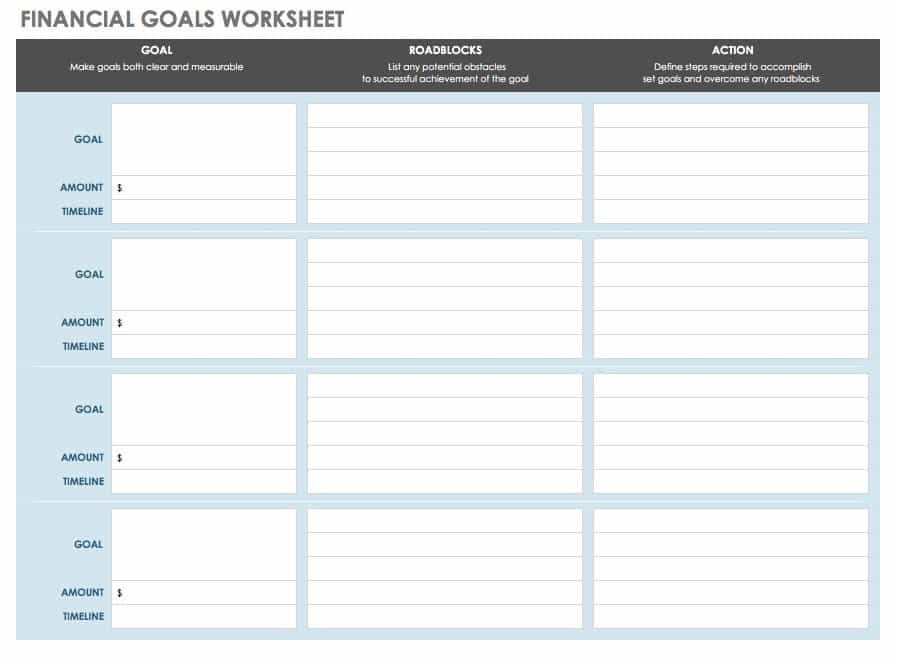

Financial Goals Worksheet

Download Financial Goals Worksheet

Excel | Word | PDF

Goals are only dreams unless you take steps to achieve them. Use this worksheet to clarify your top goals, identify potential roadblocks, and list actions you can take to overcome obstacles and reach your desired outcome. Goal planning can help prioritize objectives, create a realistic timeline, and provide accountability.

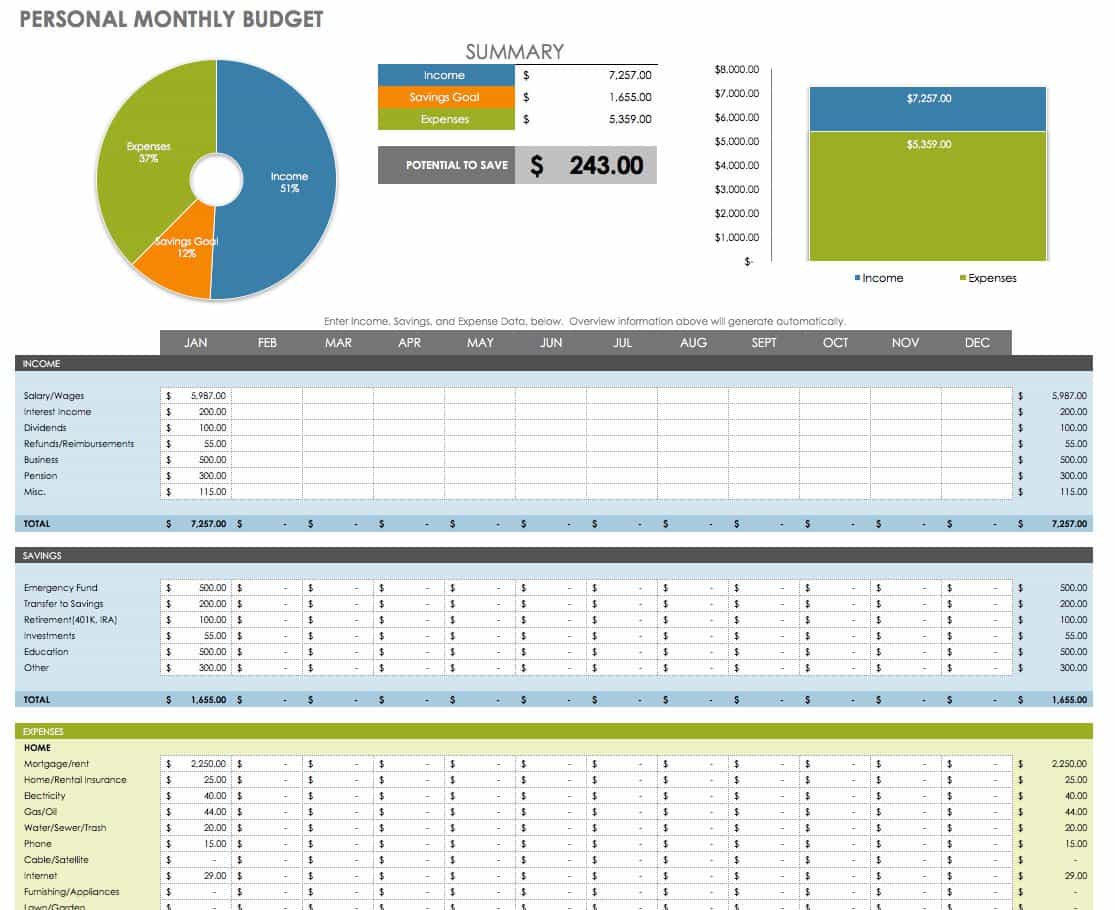

Personal Monthly Budget - Excel

Download Personal Monthly Budget - Excel

This monthly financial planner template provides a detailed budget along with a visual summary of your data. It includes sections for listing all sources of income, different savings accounts, and all of the expenses required to meet basic needs and support your lifestyle. You can use this template to plan for each month as well as to track earnings and expenditures over time.

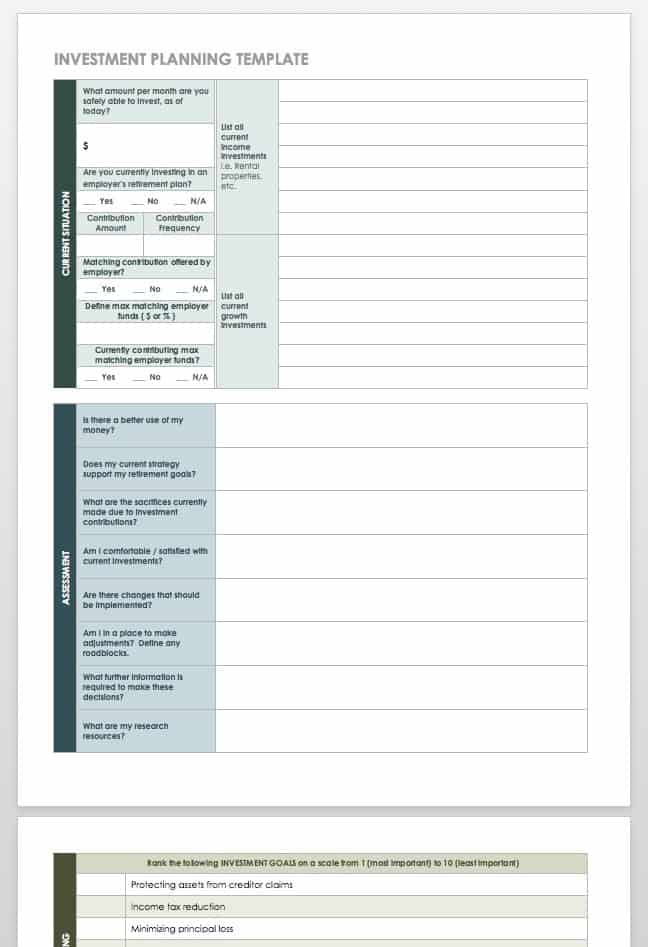

Investment Planning Template

Download Investment Planning Template

Word | PDF

Use this template to analyze your financial situation, assess your investment strategies, and determine investment goals. This worksheet can help clarify where to make changes in your current strategies and identify your comfort level with different approaches to investing. Even if you don’t have any investments, this template can provide a starting point for thinking about and planning your goals.

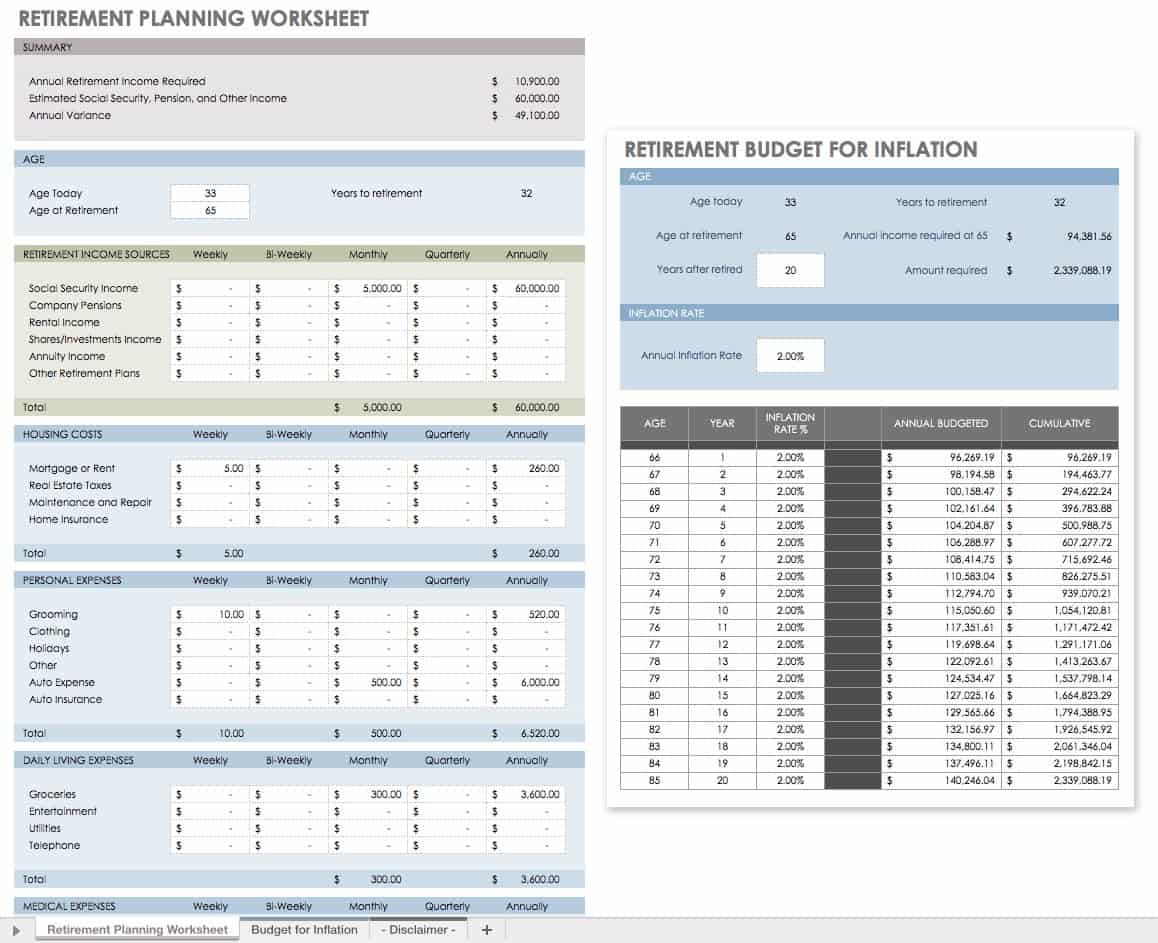

Retirement Planning Worksheet - Excel

Download Retirement Planning Worksheet - Excel

This template serves as a retirement calculator and budget worksheet that you can use to plan for retirement while accounting for inflation. If you are already retired, use the template to create a weekly, monthly, or annual budget based on your current income and expenses. You may want to consult with a financial planner to ensure that you are maximizing your income and saving sufficiently for retirement, but this template provides a basic financial planning and management tool that can help kickstart the conversation.

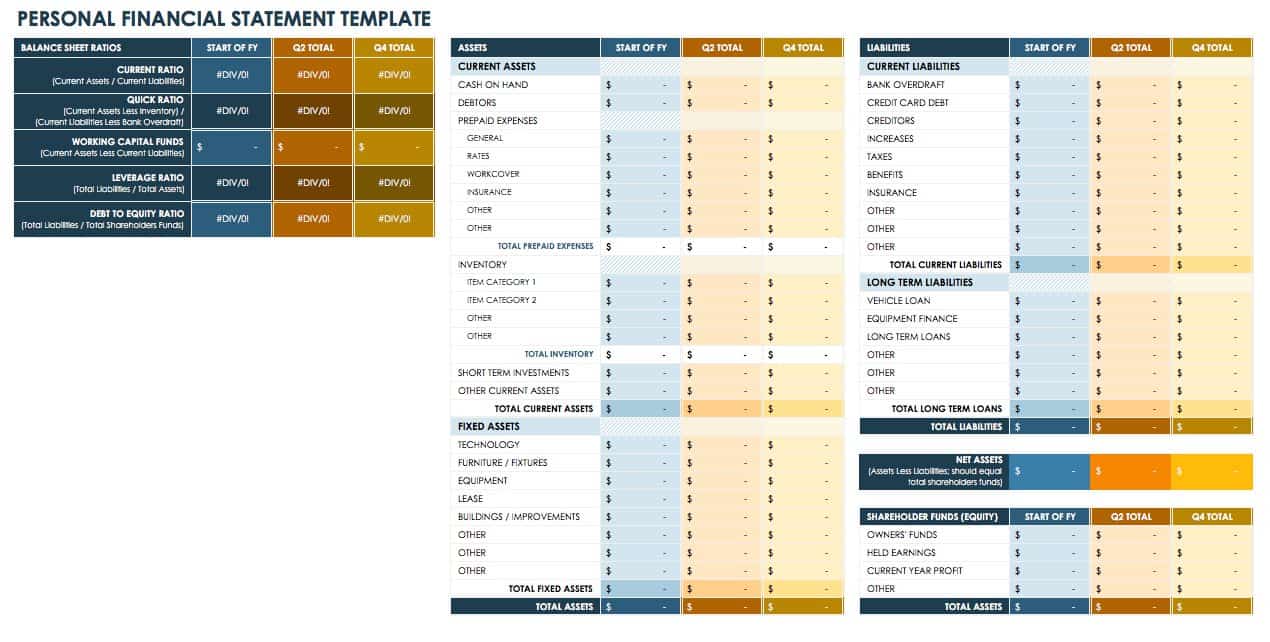

Personal Financial Statement - Excel

Download Personal Financial Statement - Excel

Determine your personal net worth with this simple yet detailed template. Enter your assets and liabilities - from cash and retirement savings to credit card debt and mortgages - and the template will automatically calculate your net worth. These details provide a quick look at your current financial standing. If you’re starting a business and seeking funding from lenders or investors, you may need to provide the information you collect in this template.

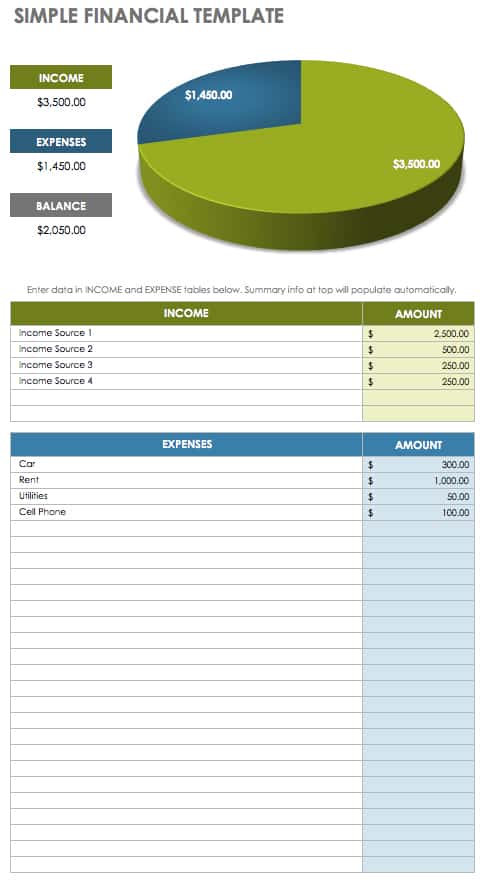

Simple Financial Template - Excel

Download Simple Financial Template - Excel

If you want to create a streamlined budget, use this simple financial template to see the difference between your income and expenses. Sections are provided for an itemized list of each, and a pie chart displays the balance between the two. This template may be helpful for individuals who are building a budget for the first time, or for those without complicated finances who just want to see how much they spend each month.

College Student Budget Template - Excel

Download College Student Budget Template - Excel

This template includes a list of potential expenses for college students. Use the details it reveals to determine how to pay for each item or where to cut costs. It also allows you to create a budget for each semester, weighing income against expenses to ensure that you have adequate funds. By creating a balanced budget, college students can focus on school responsibilities rather than worrying about finances, and also ensure that spending money is available for entertainment and wellness needs.

Improve Financial Planning with Work Management in Smartsheet

Empower your people to go above and beyond with a flexible platform designed to match the needs of your team — and adapt as those needs change.

The Smartsheet platform makes it easy to plan, capture, manage, and report on work from anywhere, helping your team be more effective and get more done. Report on key metrics and get real-time visibility into work as it happens with roll-up reports, dashboards, and automated workflows built to keep your team connected and informed.

When teams have clarity into the work getting done, there’s no telling how much more they can accomplish in the same amount of time. Try Smartsheet for free, today.

Discover why over 90% of Fortune 100 companies trust Smartsheet to get work done.

- Skip to main content

Schedule free consultation

SAMPLE COMPREHENSIVE FINANCIAL PLAN EXAMPLES

Personal financial plan examples.

Below are financial plan examples for hypothetical clients in several different situations. These plans were created by our Atlanta financial advisor team and should give you an idea of what is typically included in a plan. Hopefully, you’ll be able to find a sample plan that addresses issues you might be facing, and if that’s the case, the sample plan will provide you with a better understanding of the plan format, content and cost. Finding an Atlanta financial advisor who is a good fit can be difficult, so feel free to contact us for further information.

If, after reading the sample financial plans , you would like to attend a no-cost 90-minute workshop to create your own financial plan, click here . Please note that the workshop is only valid for U.S. residents, as all tax assumptions are based on U.S. tax regulations.

The personal financial plan examples below are just that – examples – and they aren’t meant to serve as advice. Your actual financial plan will depend upon your particular situation – your current resources, your goals and your return needs and risk tolerance among many other variables. The examples below include much of this information and cover the areas we typically address for in plans for clients with a particular need or at a specific stage in life. We typically present these plans over the course of two meetings that cover sixty to ninety minutes, during which we review a slide deck for each plan stage and answer any questions that may come up. Although not included in the sample plans below, we do create a to-do list at the end of the planning process so you’ll have a clear understanding of what needs to be done to implement your plan.

Example Financial Plan #1

Jack and Julie, a married couple whose kids are grown and financially independent, are planning on retiring in a few years

Jack and Julie are a few years away from retirement , and although there is some difference in their ages, they hope to retire simultaneously. Jack has worked for both the Federal Government and a state-run university, so he will receive two pensions in addition to the social security that they will both receive. Although Julie will not have a pension, she has saved aggressively in past years and will continue to save – albeit somewhat less aggressively – through retirement.

Jack and Julie believe that they are well situated for retirement, but they would like to better understand their financial position, and they have also prioritized survivor planning to confirm that they would both be fine should either pre-decease the other.

Financial Plan Outcome

As they suspected, Jack and Julie are in good shape for retirement, and after reviewing their plan results, they have begun to consider retiring earlier than they initially anticipated. They also have sufficient resources to financially weather a survivor situation, particularly if Jack receives an inheritance (as seems likely) from his father’s estate. Given Jack’s father’s long life, there is a higher than average chance that Jack will be long-lived, and if that is the case, it will be beneficial for him to delay taking social security.

Jack and Julie also completed a review of their other insurance coverages as well as their estate documents and existing portfolio allocation vs. the portfolio allocation used in the plan.

The retirement plan cost is $2640, and that included all work necessary to complete the plan as well as the two client meetings in which the plan was reviewed and discussed. Additionally, Jack and Julie had a few implementation questions after the final plan meeting that were covered in the fee as well.

Download Jack and Julie's Sample Financial Plan Today!

Get My Sample Financial Plan

Example Financial Plan #2

Sarah, a physician in her late 30’s focused on savings and planning for retirement.

Sarah is a doctor who works for a healthcare provider associated with a large university. She is single and in her late 30’s, and although her income has increased substantially since she completed medical school, her spending hasn’t followed suit. Thus, she is in the fortunate position of having substantial disposable income and the matching contributions from her employer to her retirement plans is generous.

She would like to retire in her mid-50’s, although she could put retirement off for a bit if necessary. In addition to contributing the maximum allowable amount to her retirement plans, she is also spending $15,000 each on paying down medical school debt and establishing an emergency fund. Sarah is seeking advice on whether or not her retirement goal is realistic, how best to achieve it and how she should invest.

Sarah is close to being on track, but she is more likely to be able to fully fund her retirement if she pushes it back to her late 50’s. Furthermore, her investments are a bit too conservative given her overall risk tolerance and return needs, so we recommend increasing her equity exposure. Lastly, she may want to consider additional disability insurance if it is available so that she can continue to meet her savings goals even in the event of long-term incapacity.

Financial Plan Cost

Sarah’s plan cost is $2,160. This cost included all work necessary to complete the plan, plus 2 client meetings to review the initial draft plan as well as the final plan, and subsequent support to answer any questions Sarah had as she worked to implement the plan.

Download Sarah's Sample Financial Plan Today!

Example financial plan #3.

David and Susan, a married couple in their late 30’s, both earn high incomes and recently made the decision to adopt twins

David and Susan are in a strong financial position, but the recent decision to adopt has led them to the decision to have a comprehensive plan done. Both David and Susan earn high incomes, and David works as a consultant while Susan splits time between research at a medical university and practicing at the university clinic .

David’s position requires a good deal of travel, and although he has no desire to retire early, he would like to find a less stressful job in his early 50s. Both David and Susan plan to continue working full time once the adoption is complete, and they may hire a nanny or consider daycare for the children. They have fundamental goals in planning: to adequately fund retirement and to fund education for the children. They want to ensure they are making optimal financial decisions and they would like to have the framework of a plan within which to make those decisions.

Plan Outcome

Given their high savings rate and low spending rate compared to their income, David and Susan are in a strong position. Nevertheless, their position can be strengthened by increasing their stock allocation slightly and by purchasing additional term life insurance to provide income to the surviving spouse in the event of premature death. We also recommend funding 529 plans to cover the educational goals, and we look closely at their various insurance coverages and methods they might use to minimize their tax liabilities.

Note that David recently became eligible for a deferred compensation plan that’s reserved for firm partners. However, the details of the plan are being finalized, and thus we have not included it here. Given its likely materiality, we would update the plan to include the deferred compensation once details are finalized.

David and Susan’s plan cost is $2640. Should they decide they want to work with Minerva on a retainer basis, the planning fee will be applied to the first quarter’s retainer fee.

Download David and Susan's Sample Financial Plan Today!

Understanding the financial planning process.

Many people look to a financial plan to be confident that they are on track for achieving their financial goals. They want to know that their financial goals and plan are realistic. Most importantly, however, they want to make sure that they’re making the best financial decisions and that they’ve prioritized their goals properly.

While many people are aware that they should have a financial plan, they might be unsure as to what the process looks like. At Minerva, we begin the financial planning process by finding out what’s most important to you and what you hope to accomplish. We’ll then focus on your short-term and long-term goals (like retirement and estate planning), and build a financial framework. When we establish your plan, we’ll give you a list of action items that you can follow to stay on track in your plan and if you work with us on an ongoing basis, we’ll work with you to ensure your plan is implemented and help you stay on track.

The sample financial plans we provide offer a glimpse into what is considered in some typical financial situations. Yet, it’s important to remember that your financial goals and situations are unique, and every financial plan is personalized. Our Atlanta financial advisor team has created plans for clients in a wide variety of situations, not just those shown above.

If you don’t find a plan above that is somewhat reflective of your situation, contact us to let us know a bit more about your situation.

Schedule a Complimentary 30-Minute Call to Discuss Your Situation

GET STARTED

IMAGES

VIDEO

COMMENTS

Financial Planning is a comprehensive analysis of your needs, wants, and wishes today that’s tailor-made just for you. Then looking into the future throughout your lifetime, your plan will estimate the confidence that these goals will be carried out using your income earning assets to pay for them.

Peak Financial Planning Advisors are Fee Only Fiduciaries and CERTIFIED FINANCIAL PLANNER PROFESSIONALS. Use this link to schedule a free consultation with us to learn more about working with our fee only, fiduciary financial advising team to build your financial plan.

Download free financial templates for business and personal planning, including strategic financial plans, annual projections, and goal planning sheets.

Below are financial plan examples for hypothetical clients in several different situations. These plans were created by our Atlanta financial advisor team and should give you an idea of what is typically included in a plan.

Our personal financial plan example will help you create your own, so you know what actions to take to achieve your financial goals! What is a financial plan? A financial plan is an overall view of your finances and is key to the financial planning process.

We have prepared the following report for Jane, along with the accompanying Excel spreadsheet. Lifestages Financial Planning Services has developed a comprehensive financial plan for your next forty-five years. This life-long plan explores the best allocation of your income and financial assets.