Case Studies Subscribe

How Bel Brands USA modernized the look of Merkts Cheese Spread to entice next-gen consumers yet keep loyalists

In 2020, Bel Brands USA’s eponymous cheese spread, Merkts, marked 70 years as a consumer staple.

The tale of two cold-storage warehouses: automating Aurora Organic Dairy

Challenged with a lack of space to accommodate a large warehouse addition, Aurora reached out to Westfalia Technologies to design an Automated Storage/Retrieval System (AS/RS).

Recruitment, Responsiveness & Sustainability

.jpg?1656621292)

While one assessment found that dairy industry executives remain optimistic about the sector’s overall outlook, many identify supply chain disruptions as one of the top concerns for the year ahead.

Priamo Food Technologies transports traditional mozzarella-making out of Italy for Fratelli Amodio

A complete mozzarella ball processing line supplied by Priamo (part of the Della Toffola Group in Italy) is helping Neapolitan cheesemaker Fratelli Amodio supply overseas consumers with the same taste, texture, and quality expected from an Italian-made cheese, without the added export and transportation costs associated with manufacturing in Italy.

Graham’s, The Family Dairy changes skyr packaging to increase sustainability

Dungannon, Northern Ireland-based Greiner Packaging has been supplying Graham’s, The Family Dairy (Graham’s) with packaging for almost 10 years.

.jpeg?height=168&t=1631196419&width=275)

Peekaboo Organics scoops out hidden data

Surfside, Fla.-based Peekaboo Organics founder Jessica Levison wasn’t planning to become an ice cream manufacturer. She was a lawyer before opening a boutique scoop shop in Miami 13 years ago, which became popular for its delicious flavors and creative ingredients.

.jpg?height=168&t=1626962658&width=275)

Artisan cheese, yogurt producer modernizes to captures competitive edge

Fortress Technology’s smart metal detector boosts efficiency for cheese supplier

Cheese processor uses heat exchangers to increase cheese-drying capacity

New packaging line at O-At-Ka Milk Products boosts production of RTD beverages

DOCUMENTS AND FILES

Partial demineralization and concentration of whey permeate by nanofiltration.

DOW was invited to participate in a competitive field trial comparing five Dairy nanofiltration elements available on the market. The purpose was to determine which elements provide the best overall performance concentrating and demineralizing lactose over a period of 12 months. The results show that FILMTEC™ NF245 membrane consistently outperformed the other elements and maintained the highest lactose rejection and highest salt permeability. Additionally, FILMTEC NF245 had 16 percent higher permeate flow than the competition.

Dollars from Waste

Dion Label reduces its environmental impact and saves money by pelletizing its waste.

AstaREAL astaxanthin

Supported by a full spectrum of research, this is a powerful and well-substantiated antioxidant.

Keeping Food Containers Safe is an E-Z Task

When Huhtamaki Packaging entered a contract with a national yogurt producer, the yogurt company requested that every container be inspected by a metal detector before being shipped. So it purchased six E-Z Tec DSP metal detectors from Eriez.

Stay ahead of the curve. Unlock a dose of cutting-edge insights.

Receive our premium content directly to your inbox..

Copyright ©2024. All Rights Reserved BNP Media.

Design, CMS, Hosting & Web Development :: ePublishing

A winning growth formula for dairy

Dairy is a ubiquitous part of food life, ever present in both food service and packaged goods, whether as an end product (such as milk or yogurt) or as a critical input for iconic products such as cheese pizza. Given its intrinsic presence, dairy is a microcosm of the food industry, with the preferences of dairy consumers largely being influenced by the same trends affecting the broader food sector.

Stay current on your favorite topics

Changing consumer behavior, competition, and trade action have resulted in slow growth for dairy companies . Research into a representative sample of global dairy companies revealed a 3.0 percent drop in cumulative return on invested capital (ROIC), from around 9.5 percent in 2008 to 6.5 percent in 2017. During the same period, revenue and margin growth have been 2 and 3 percent a year, respectively. The decline in ROIC suggests that revenue and margin growth are not keeping pace with the cost of capital to generate economic value. Nonetheless, the top five global dairy companies were able to increase their margins by 4.1 percent from 2013 to 2017.

So, while the market is facing some headwinds, growth is possible but will rely on finding the right pockets of demand, domestically and internationally, and having the right agility and operating model .

A look at the US market tells a cautionary tale: from 2015 to 2018, top dairy products experienced retail-sales declines, including cheese (–1.4 percent), milk (–4.9 percent), and yogurt (–2.3 percent). 1 Fast-moving-consumer-goods data for the three years ending the week of November 3, 2018, Nielsen, nielsen.com. In contrast, sales of plant- and nut-based beverages in 2017 were up $141 million, or 9 percent, from 2015 levels. 2 “The dairy case is more competitive than ever,” American Farm Bureau Federation, August 29, 2018, fb.org.

On a value basis, the market share of nut- and plant-based beverages has increased from just below 10 percent in 2015 to more than 13 percent through July 2018. During this same time, the market share of traditional milk beverages has dropped from more than 90 percent in 2015 to around 87 percent in 2018.

Interviews and surveys conducted in the fourth quarter of 2015 and 2018, with 56 dairy CEOs, revealed that CEOs changed their attitude toward the nondairy-alternative market: 36 percent of CEOs believed that the nondairy-alternative market would continue to grow in 2015, while 51 percent believed it in 2018 (Exhibit 1). “Among millennials, we are seeing a shift to nondairy, plant-based proteins,” one CEO reports. “We need to build relationships with these plant-based-protein companies.”

About the research

To develop our insights, we surveyed a subset of International Dairy Foods Association members and conducted interviews and surveys with 56 CEOs of international dairy companies. These findings were augmented by discussions with industry experts and McKinsey research. In addition, we partnered with an omnichannel data provider to survey more than 1,000 US households on their dairy preferences. The survey was in the field from November to December 2018.

Internationally, developed regions such as Europe and North America face a growing dairy surplus. For example, by 2027, the United States will be producing 12 million metric tons milk equivalent (26 billion pounds) more than the domestic market will consume. Developing markets, especially in Africa and Asia, offer a mirror image, with large supply shortages. China, for example, will have a forecast dairy deficit of 26 million metric tons milk equivalent (57 billion pounds) in 2027.

In collaboration with the International Dairy Foods Association (IDFA), McKinsey conducted research to understand the strategies and capabilities required to help US dairy grow domestically and internationally in the coming years (see sidebar, “About the research”).

Where is the domestic growth, and how can companies capture it?

In the traditional food industry, growth has been slowing for several years because of shifting demographics and the emergence of niche products. As US food and dairy executives seek to adapt to this new reality, seven major trends—all applicable in varying degrees to both food and dairy—are shaping the consumer-packaged-goods (CPG) industry .

In our dairy CEO interviews and surveys, CEOs were invited to list up to three innovations considered to be the most relevant for the US dairy industry. In 2015, the three most prominent were Greek yogurt, organic, and nondairy alternatives. In 2018, the three most prominent changed to Fairlife, 2 “The dairy case is more competitive than ever,” American Farm Bureau Federation, August 29, 2018, fb.org. protein, and packaging.

However, this field is evolving quickly, and CEOs admit that their understanding of consumers can be improved. In fact, consumer-insight capabilities ranked last in a list of competitive advantages. As one CEO put it, “Dairy companies need a better understanding what the consumer values and then connecting that with what we do.”

1. The millennial effect

As of 2018, millennials now have more spending power than any other generation. Much has been written about the disruption caused by millennials due to their unique preferences and values as consumers. Empowered by digitization, millennials are, on the whole, more diverse, more sophisticated, and more demanding. They prefer to shop in channels beyond the mass market and gravitate to up-and-coming brands rather than established ones.

Compared with baby boomers, for example, millennials are 2.8 times more likely to believe newer brands are better or more innovative and 3.7 times more likely to avoid buying from “big food.” In addition, millennials are more inclined to engage with “non-brand-generated” content such as consumer reviews and social media.

More important, perhaps, is how the behavior of millennial consumers is influencing shoppers across generations. Increasingly, consumers are demanding experiences, not just products. This preference places the onus on CPG companies to establish relationships and bolster loyalty by maintaining an ongoing dialogue with customers.

These same patterns are evident in the dairy industry, which sees diverse consumers who exhibit a range of preferences and behaviors. Although nearly half of US consumers are still content with their current brand, a slim majority have explored other options in the past 12 months. Our survey found that 32 percent of US consumers are buying more private-label and store brands, while 20 percent (27 percent for the millennial age group) reported buying more premium and niche brands (Exhibit 2). US dairy consumers are also open to trying new brands and switching or expanding their purchase selection: 42 percent report trying a new brand in the past 12 months, and 48 percent of new-brand purchasers continue to buy both old and new brands.

In addition, a majority of consumers have expressed an interest in knowing more about the manufacturing of dairy products, including ingredients, manufacturing processes, and sourcing practices (Exhibit 3). Our survey found that 82 percent of consumers “must know” or “would like to know” more about product ingredients, and 70 percent express a similar desire for information on sourcing practices. No differences were observed for millennials. These results are consistent with other research conducted by the Center of Food Integrity, which shows that around two-thirds of US consumers are interested in knowing more about agriculture and food-manufacturing practices. The desire of consumers to know more about products represents an underdeveloped opportunity for growth.

2. Better for you

Consumers are redefining what “healthy” and “better for me” mean, increasingly demanding products that are natural, green, organic, and free from additives. Indeed, a focus on health and wellness is no longer a strategic differentiator but a must-have for many CPG categories.

The most successful product launches around the world deliberately target consumer concerns for health. And customers have made reviewing product information a regular step before purchase: instead of automatically placing a familiar product into their shopping cart, they are now scrutinizing labels for unpronounceable ingredients, artificial flavors and colors, genetically modified organisms, and high levels of sweeteners and sodium. This emphasis has translated to faster sales for fresh produce and health-oriented packaged goods. In the United States, organic foods are projected to grow at eight times the rate of some processed packaged-food categories from 2016 to 2021.

Would you like to learn more about our Consumer Packaged Goods Practice ?

Our survey showed 35 percent of dairy consumers report eating healthy foods, and 32 percent have read nutrition labels over the past 12 months. No significant differences in this behavior were observed across age cohorts. Moreover, health is not only an issue for young consumers and mothers. As a market segment in developed economies, the retired elderly are projected to grow from 164 million in 2015 to 222 million in 2030. This group will generate 51 percent of urban consumption growth. Creating dairy products that address the nutritional needs of this group will be critical for growth in developed markets such as the European Union and the United States.

The top three attributes associated with healthy eating are “all natural,” “low sugar,” and “organic.” Survey respondents who decreased their consumption cited three reasons: plant-based dairy products are healthier, a desire to try new products, and dietary requirements. Consumers generally favor protein over fat for health, and plant-derived products over animal-derived ones.

However, dairy companies may have an opportunity to strengthen health claims, since consumer perceptions are often contradictory and vary across categories. For example, consumers are both migrating away from and toward butter for health-related reasons, resulting in a net 4 percent gain in year-on-year sales.

3. Infinite intimacy

The increased penetration of mobile devices and digital profiles is creating an unprecedented volume of data for savvy companies to collect from a wide variety of consumer and nonconsumer sources (such as loyalty-card data, trends, preferences, and weather forecasts that could influence purchases). At the same time, advanced tools and techniques are enabling companies to interpret vast amounts of data, allowing them to create highly personalized microsegments—even down to “segments of one.” Purchasing behavior is increasingly influenced by recommendation algorithms, and leading CPG companies are relying more on search-engine optimization to promote products online. And, in stores, retailers are using data to personalize the shopping experience, from mobile recommendations to targeted communications and product information.

Consumers have responded favorably: despite making up a smaller portion of total sales, upstart brands account for an outsize share of growth in CPG segments such as food and beverage.

4. Retail revolution

The retail landscape is being reshaped by structural channel shifts. The emergence of value discounters and the growth of omnichannel retailers (especially Amazon) have led to channel fragmentation and bifurcation. Consumers have shifted to discounters or higher-end channels, putting pressure on players in the middle. Retailers are seeking to meet changing consumer needs and distinguish themselves from the competition by looking beyond stagnant large brands, instead selecting smaller, high-growth brands and model disruptors. A business model battle is under way in retail, with the e-marketplaces emerging as the uncontested leaders. In a review of the top 14 global players, e-commerce companies grew at a 25 percent compound annual growth rate (CAGR) from 2011 to 2016. By contrast, mass-market retailers lost 0.1 percent during the same period. These divergent trajectories have made channel strategy top of mind for dairy executives.

To date, the impact of this trend has been less pronounced in dairy. Grocery e-commerce is set to grow at 34 percent from 2017 to 2025, but the share of US consumers who indicate they will buy dairy products online will remain flat. However, consumers are becoming more comfortable with using online channels to support purchasing decisions. Around 25 percent of survey respondents compare dairy prices online before shopping and have used a digital coupon to buy dairy products. Survey respondents who purchased goods through e-commerce channels cited time savings and lower prices online as the main reasons.

5. Explosion of small

Across the CPG industry, smaller brands are realizing more momentum than larger brands or private label due to the ability to capture an intimate brand story at moderate scale. The democratization of technology is a critical element of the heightened competition: advancements have made a range of tools affordable for even the smallest companies, leveling the playing field and lowering the barriers of market entry. Many of these start-ups have embraced leaner operating models and a much shorter go-to-market cycle, all supported by technology, in the process gaining an advantage over larger incumbents. Consumers have responded favorably: despite making up a smaller portion of total sales, upstart brands account for an outsize share of growth in CPG segments such as food and beverage. For dairy companies, this trend stands out in contrast to the traditional industry focus on cost efficiencies and scale. Incorporating flexibility will be important as executives seek to expand to other consumer segments and jump-start growth.

In dairy, small and medium-size companies were responsible for all the gains in the US dairy market from 2015 to 2018, adding $1.1 billion in revenues, a 3.8 percent CAGR. Meanwhile, private-label and large categories saw their sales decline by $1.4 billion and $1.0 billion, respectively (Exhibit 4). Consumer interest in smaller dairy companies and start-ups was partly responsible for this segment’s growth. Over the past 12 months, 41 percent of survey respondents reported trying a new dairy brand. Ten of the 16 brands were those of small and medium-size companies, including companies known for innovative takes on traditional dairy products.

However, small-company growth was not enough to offset total category decline: since these companies generally have a higher price point than other enterprises, this result was likely caused primarily by changes in market share rather than bringing new consumers to the category.

However, consumers are willing to try new products. Forty-one percent of dairy consumers report having tried a new dairy brand in the past 12 months, and of this group more than 70 percent kept this new offering in the mix. This pattern creates an opportunity for growth.

6. Pressure for profit

The CPG industry has set higher expectations for spending transparency and the strategic redeployment of commercial resources. In trying to tailor value propositions to excite an increasing number of consumer microsegments, CPG companies face rising commercial costs from SKU growth, channel proliferation, and media fragmentation. In food and beverage, for instance, the number of channels that marketing campaigns must cover nearly tripled from 2012 to 2017. These trends largely hold true for the global dairy industry.

Many companies, seeking to increase transparency of spending and return on investment (ROI), have adopted zero-based budgeting and the rigorous management of revenue growth and performance. Only some are investing to increase transparency and maximize ROI of every commercial dollar spent. Leading companies, however, achieve greater transparency by viewing spending holistically and marketing and sales as an integrated commercial function. They also deliberately and strategically redeploy resources to maximize profitable growth.

In the pursuit of profit, international dairy companies indicated that their top source of competitive advantage was a focus on manufacturing efficiencies, followed by product innovation and customer service (Exhibit 5). Notably, consumer-insight capabilities were cited by just 2 percent of respondents, suggesting that investments in this area could support more targeted marketing and consumer engagement.

7. Other trends shaping the domestic market

Dairy companies in developed markets are also facing industry developments and patterns that further complicate efforts to grow. Margin pressure at every stage of the value chain in their home countries means gains must be sought by expanding into new markets. Consolidation and vertical integration, led by large farmers, is putting pressure on the remaining small and medium-size farms, which then must make difficult strategic decisions in an effort to remain competitive. For instance, shrinking margins have made it harder for milk processors to justify capital expenditures.

The fewer, more productive farms that remain have caused supply to grow faster than demand, another key reason why the search for growth requires dairy companies to adopt a global perspective.

These developments, particularly industry consolidation, have reduced the impact of efficiency gains on operations. The disruption of international trade by tariffs and the strength of the US dollar are further influencing the competitive landscape in developed markets.

Crafting a domestic growth strategy

Given the heightened level of competition and surplus production in the United States, domestic dairy companies should concentrate their effort and resources in three areas:

Identify growth areas through analytics

Case study: halo top.

Los Angeles–based Halo Top Creamery, which was founded in 2011, has garnered a loyal customer base by developing ice-cream products with a unique combination of low calories, high protein, and good taste. In 2015, the company simplified its packaging to ensure that the calorie count was displayed front and center below the ice-cream’s name. The following year, Halo Top reported growth of 2,500 percent, increasing its sales channel with 34,000 stores in the United States in addition to stores in Australia, Canada, Ireland, Mexico, and the United Kingdom.

The company used social-media ads and recommendations from YouTube fitness experts to increase its online presence. Thanks to growing demand, in 2017 Halo Top became the most successful food and beverage brand in United States, with sales of $324.2 million.

Companies must get a better understanding of their target consumers—exactly what they value in their dairy products—to expand their market share. Finding these pockets of growth increasingly depends on greater visibility courtesy of data and analytics. These insights will inform strategic decisions across innovation, marketing, pricing, and assortment. A primary goal should be to combine product features such as ingredients, packaging, and cost in order to fulfill the needs of a particular consumer segment.

Make many quick, small investments versus a few big bets

Getting new products successfully into market is vital. In all, 83 percent of IDFA survey respondents have increased their product portfolio in the past five years. Yet companies that have invested in a few big bets have not improved outcomes. A comparison of large and small packaged-food companies that launched new products in 2013 shows that each segment had the same success rate four years later—25 percent (Exhibit 6). Evolving consumer tastes and the desire for products that address specific needs means that many products never find an audience. But by building the capabilities to develop and launch more products, companies can get a better sense of consumer tastes before investing in order to scale production and serve new markets.

Invest in new supply-chain capabilities

Case study: walmart.

Current tracking methods in supply chains are antiquated, making it difficult to track goods from origination to delivery. Walmart has been experimenting with blockchain in an effort to improve traceability, food safety, and access to supply-chain information. Through blockchain, the company has a real-time view of product information on a single, safe platform. The impact has been game changing: Walmart has reduced its time to trace a package of mangoes on its journey from farm to store from days or weeks to two seconds.

To build on this initial success, the company is planning to require suppliers of leafy greens to use blockchain for a farm-to-store tracking system that will launch in September 2019, with a similar system for other fresh-fruit and vegetable providers slated to go live soon after.

Just as dairy companies must adapt their operations to be more nimble and serve specific customer segments adroitly, so too must their supply chains become more responsive to changing demands. Three areas should be priorities.

Flexibility and agility. Companies should seek to develop modular and flexible manufacturing that can scale as required or be quickly converted to serve an adjacent product offering. Dairy companies can partner with other stakeholders across the supply chain to innovate and build capabilities. These partnerships can also increase cost transparency by giving stakeholders greater visibility into each step, which supports collaboration and increases trust.

Distribution. Innovations such as kitting and customized packaging have enabled the more effective distribution of goods in perimeter categories (especially with the growth of e-commerce). In addition, dairy companies can establish capillary networks to gain access to growing channels such as farmers markets. Last, advanced order and management capabilities can give dairy companies the tools to ensure the right inventory at the right place at the right time.

Technology. Traceability systems and a stable backbone comprising data, analytics, and digital technologies can improve supply-chain performance. Agriculture companies, for example, have applied blockchain to improve food safety by decreasing the time taken to track inputs. Similarly, IoT-enabled logistics can help companies manage their fleet and improve food-safety control through environmental sensing. And digitization and analytics are used to enable predictive analytics in demand planning and analytics-based end-to-end network optimization. These advances can reduce spoilage in transit from manufacturer to retail shelf and also accelerate the identification of food contamination in the event of foodborne-illness outbreaks.

Identifying and capturing international growth

Even US incumbents that have managed to maintain a solid market share in their home market will be hard-pressed to capture significant additional value in the coming years. According to our analysis, from 2008 to 2017 companies with a global focus have increased their revenues significantly, while those active in local markets have seen their revenues fall. Global companies also have higher margins, with earnings before interest, taxes, depreciation, and amortization of 15 percent in 2017, compared with 10 percent for local companies.

The new model for consumer goods

Our dairy CEO interviews and surveys revealed that the direction of the industry has switched, from a domestic focus to an export focus, between 2015 and 2018. One CEO warned, “To compete internationally we must shift our mind-set from being an exporter to a global partner.” In 2015, 20 companies (36 percent of those surveyed) had no exports and no plans to export. In just three years, that number dropped to 6 (a drop of 70 percent). Among those that already exported in 2015, there was a steady increase both in the number of those with no plans to further expand (43 percent) and those with continued plans to expand (53 percent).

Despite the recognition that international markets offer the potential of higher growth, many US dairy companies are ambivalent about pursuing this opportunity. While 87 percent of respondents currently export, just over half indicated that they will invest in more exports in the near future. At the same time, 47 percent have no additional plans to increase their exports—perhaps because the current trade environment has made exporting a more difficult strategy.

High-growth opportunities

An examination of the global map identifies a significant mismatch in production capacity and demand. The United States, for example, already has a significant surplus of dairy products, a total that will more than double by 2027 (Exhibit 7). In the longer term, US dairy exports are not fully aligned with future demand, suggesting an opportunity to look to new markets. The regions and countries with the largest dairy deficits—Africa and Asia—are currently not well served by the US dairy industry.

Global competition to serve these markets will be fierce, however. The European Union as well as Australia and New Zealand have a significant surplus and are better positioned to serve Africa and Asia—an advantage that goes beyond geographical proximity. The European Union has negotiated 11 free-trade agreements with Africa and eight with Asia (excluding China and India), while Australia and New Zealand have secured 11 agreements with Asia (excluding China and India). The United States lags far behind, with just four trade pacts across Africa and Asia combined.

Unexpected tariff movements over the past five years will continue to occur. This will test the ability of US dairy companies to manage risks. In 2014, Russia’s embargo on several traditional western suppliers 3 Fairlife is an alternative to milk. was one of three factors leading a dairy-market downturn. Currently, tariffs are affecting $1 billion of exports to China and Mexico. Those events reinforce the need for planning and diversification to mitigate the impact of disruptions.

One area of growth in retail is global emerging markets. According to the McKinsey Global Institute, emerging economies have accounted for almost two-thirds of the world GDP growth and more than half of new consumption over the past 15 years. Urban growth is another driver: one billion people in rapidly growing cities will become consumers by 2025. These trends make it clear that the future of dairy is global and that the next generation of consumers will be in cities that have yet to achieve prominence.

The burgeoning global middle class, especially in developing markets, represents a high-value target for US dairy companies (Exhibit 8). Leading trends for these consumer segments are convenience, snacking, and food innovation. Dairy companies can easily use their capabilities and size to reach out to these consumers and grow beyond their core markets.

Rising income levels are a promising indicator, but they don’t tell the whole story. Asia has the most potential as measured by the number of consumers and GDP per capita, for example, but dairy faces a slow adoption curve. By comparison, Latin America, where dairy is considered a basic staple, has higher consumption at lower GDP per capita.

Also, many emerging markets have a lower degree of consolidation than those in which the EU and US retailers command less power. These opportunities can be transformed into advantages with the right mix of scale and innovation.

Crafting an international growth strategy

US dairy companies with a presence in international markets will need to pursue a two-pronged strategy to expand their global footprint. The current uncertainty in global trade will force companies to play defense to maintain their position in existing markets. Sixty-three percent of CEOs think that the recent declines in the US industry are structural and not cyclical (Exhibit 9). As a first step, they should systematically and proactively identify risk by developing insights on supply, demand, policy and political factors, and trends. With this more detailed view of the markets and relevant exogenous factors, executives can build a robust tool kit of financial and demand-hedging tools to manage risk as it occurs. Proactive risk management can enable companies to increase the resilience of their supply chain by collaborating closely with customers and suppliers. Such efforts can help dairy companies develop contingency plans in the event of unforeseen challenges.

At the same time, US dairy companies should take actions to play offense and capture growth in selected global markets. By choosing countries where the United States has trade agreements in place and by making strategic investments, companies can enter markets with long-term dairy deficits. Focusing primarily on export growth in general will not be enough, however, since the US free-trade-agreement network trails that of other countries. US companies can use advanced analytics to pinpoint territories that are a good fit and speed product development and testing. Robust manufacturing and a resilient and geographically diversified supply chain are also critical factors in successful international expansion, so dairy companies should devise long-term strategies for capital, talent, and products.

When companies combine defensive risk management and proactive investment, they can unlock a positive cycle of global growth. However, expansion in the current landscape will also require dairy executives to adopt a different mind-set. An emphasis on agility in core operating systems and innovation can enable products to be developed and introduced to market more rapidly. This capability should be matched with a venture capital approach to investments, in which a series of smaller investments are used to identify promising ideas, introduce a minimum viable product to market, and then scale up based on consumer response.

Core beliefs for success

McKinsey has developed a set of core beliefs to succeed in international expansions across different sectors:

- Profitability in international markets is strongly affected by end-to-end industry structure (including channels) and barriers to entry. Early due diligence and input from market experts can help companies understand the risks and limitations in a given market.

- Having a defined route-to-market strategy (including infrastructure) is critical to winning and influences where companies choose to play.

- Economies of scale are crucial in building the relationships, brand, and other capabilities needed for a profitable and sustainable international business. Markets that are still in the early stages of consolidation are good targets for companies that have learned to scale up quickly.

- Companies should adopt a market-specific approach that takes into account how consumer needs and perceptions differ in each market. Each market is different, so neglecting to understand and adapt to the preferences of local consumers is a recipe for failure.

- International growth gives rise to new uncertainties (for example, regulations, currencies, and import restrictions), so companies must develop new capabilities to manage these risks. The difference between failure and success in international expansions is a company’s ability to learn from its mistakes.

- A company’s geographic strategy should be integrated into its overall corporate strategy and culture. Further, resources should be carefully allocated (for example, the decision to infuse talent into other geographies). International strategies must be aligned with a company’s business models and capabilities, since it is challenging to build core capabilities that don’t exist or aren’t supported by the parent company.

Last, developing a successful international strategy requires an evaluation of the following factors:

- Category attractiveness. What category matches the company’s value proposition?

- Market opportunity. What is a market’s potential versus the risk, to determine the ease of reaching scale and growth.

- Fit with capabilities and market dynamics. Are consumer preferences and the market structure compatible with the company’s competences and abilities?

- Opportunity and risk assessment. What are the timelines, opportunity size, risks, and resources required to enter a market?

- Market entry options. Structure (such as partnership, joint venture, and M&A) as well as the resources required to execute.

Moving forward

Given the shifting landscape and long-term trends, each dairy company must determine the right strategy based on its current capabilities and footprint. At a high level, our analysis suggests that a combination of four strategies offer a path to growth.

- Deploy deep consumer-preference analytics to identify and serve pockets of growth.

- Reimagine the supply chain, making it more agile and flexible, to serve new demand niches.

- Serve demand growth in areas with projected deficits. Depending on specific geographies, the free-trade-agreement network might be the first step in identifying export markets.

- When exporting is not a possibility, or if the goal is to maximize long-term value capture or market exposure, investing directly in deficit markets to serve them locally is the way to go.

A rapidly changing consumer and global environment requires a bold new outlook and a growth model that can deliver on this challenge.

Christina Adams is an associate partner in McKinsey’s New York office, Isabella Torres Maluf is a consultant in the New Jersey office, Miguel Ramirez is a specialist in the Denver office, and Roberto Uchoa de Paula is a senior partner in the Chicago office.

The authors wish to thank Ludovic Meilhac, Nicholas Michael, and Katie Schnitzlein for their contributions to this article.

Explore a career with us

Related articles.

Agility@Scale: Solving the growth challenge in consumer packaged goods

Marketing’s hidden treasure: Better CPE can unlock millions to fuel growth

- Add company

Estimated reading time: 4 minute s

The rise of ultra-filtered milk, implementing renewable energy in dairy processing, advancements in dairy product traceability, case studies in dairy processing innovation.

The dairy industry has long been a cornerstone of agricultural production worldwide, providing essential nutrients through a variety of products such as milk, cheese, yogurt, and butter. However, as global demand increases and environmental concerns grow, the sector has been under pressure to innovate. This article explores three pivotal case studies where dairy processing innovation has not only improved efficiency and product quality but also addressed sustainability challenges. These examples serve as a testament to the potential for innovation within the dairy industry to meet the demands of the 21st century.

One of the most significant advancements in dairy processing in recent years is the development of ultra-filtered milk. This process involves the removal of lactose and a portion of the water content from fresh milk, resulting in a product that is richer in protein and calcium while being lower in sugar. The case of Fairlife, LLC, a subsidiary of Coca-Cola, exemplifies the successful commercialization of ultra-filtered milk. By employing an innovative filtration process, Fairlife has been able to produce milk that not only caters to the nutritional needs of a diverse consumer base but also extends the product's shelf life.

The benefits of ultra-filtered milk extend beyond its nutritional profile. The concentration process significantly reduces the volume of the product, which in turn lowers transportation and storage costs. Moreover, by removing lactose, the product becomes accessible to lactose-intolerant consumers, thereby expanding the market. The environmental impact is also noteworthy; the process results in reduced waste and energy consumption compared to traditional milk processing methods. Fairlife's success has spurred other dairy producers to explore ultra-filtration, marking a transformative shift in the industry.

Another area of innovation within dairy processing is the adoption of renewable energy sources to power operations. The case of Straus Family Creamery in Northern California highlights how integrating sustainable practices can lead to operational efficiencies and environmental benefits. Straus Family Creamery has become the first 100% certified organic creamery in the United States, with a strong commitment to environmental stewardship. A key component of their sustainability strategy is the use of methane digesters, which convert cow manure into biogas. This biogas is then used to generate electricity, significantly reducing the creamery's reliance on fossil fuels.

The implementation of renewable energy sources in dairy processing not only mitigates the environmental impact of operations but also leads to cost savings in the long term. The initial investment in renewable energy technologies, such as solar panels and methane digesters, can be offset by lower energy costs and potential government incentives. Furthermore, these practices enhance the brand's image, appealing to consumers who are increasingly concerned about the environmental footprint of their purchases. Straus Family Creamery's approach demonstrates how sustainability and profitability can go hand in hand in the dairy industry.

Ensuring the safety and quality of dairy products is paramount for consumer trust and regulatory compliance. Recent advancements in traceability technology have revolutionized how dairy processors monitor and manage their supply chains. A notable example is the implementation of blockchain technology by Fonterra, one of the world's largest dairy exporters based in New Zealand. By leveraging blockchain, Fonterra has created a transparent and secure system for tracking the production, processing, and distribution of its dairy products.

This technology enables consumers to trace the origin of their dairy products back to the farm, providing assurance of quality and safety. For dairy processors, blockchain offers a robust tool for managing supply chain risks, improving operational efficiency, and complying with increasingly stringent regulatory requirements. The adoption of blockchain in dairy processing also facilitates greater collaboration between farmers, processors, and retailers, fostering a more integrated and responsive supply chain.

In conclusion, the dairy industry is undergoing a transformative phase, driven by innovation in processing technologies and sustainability practices. The case studies of ultra-filtered milk, renewable energy integration, and advancements in product traceability illustrate the potential for the dairy sector to adapt to the challenges of the 21st century. These innovations not only enhance the efficiency and sustainability of dairy processing but also offer new opportunities for product development and market expansion. As the industry continues to evolve, it is clear that innovation will remain a key driver of growth and sustainability in the dairy sector.

This might interest you:

Revolutionizing soil health: the future of no-till farming.

Daniel Harris

Optimizing Soil Health: A Guide to Sustainable Crop Cultivation

BECOME A MEMBER

MEMBERS AREA

VIEW YOUR BASKET

School milk case studies

School milk knowledge hub.

Sharing practical experience and resources from around the world

Milk is an integral part of food systems and part of the solution to sustainably nourishing a growing population.

The dairy community understands that milk and dairy foods are essential to supporting the health of children worldwide. By working together and in partnership with organizations across all levels, from local and regional to national and global, the dairy community can empower stakeholders to understand and incorporate policies and programs like school meals to support children’s access to nutritious foods.

Share this page

Case studies

National School Milk Programme (Dairy Association of China, 2021)

Providing milk and free lunches across schools in China

Working in partnership to deliver milk to school children in Uganda

In Uganda, low levels of milk consumption, combined with deficiencies in other key food groups, has contributed to high levels of malnutrition.....

Working in collaboration to deliver fortified milk to Yemeni school children

In Yemen, there is an initiative to address the issues of food safety and access to safe nutrition in schools with UHT technology.....

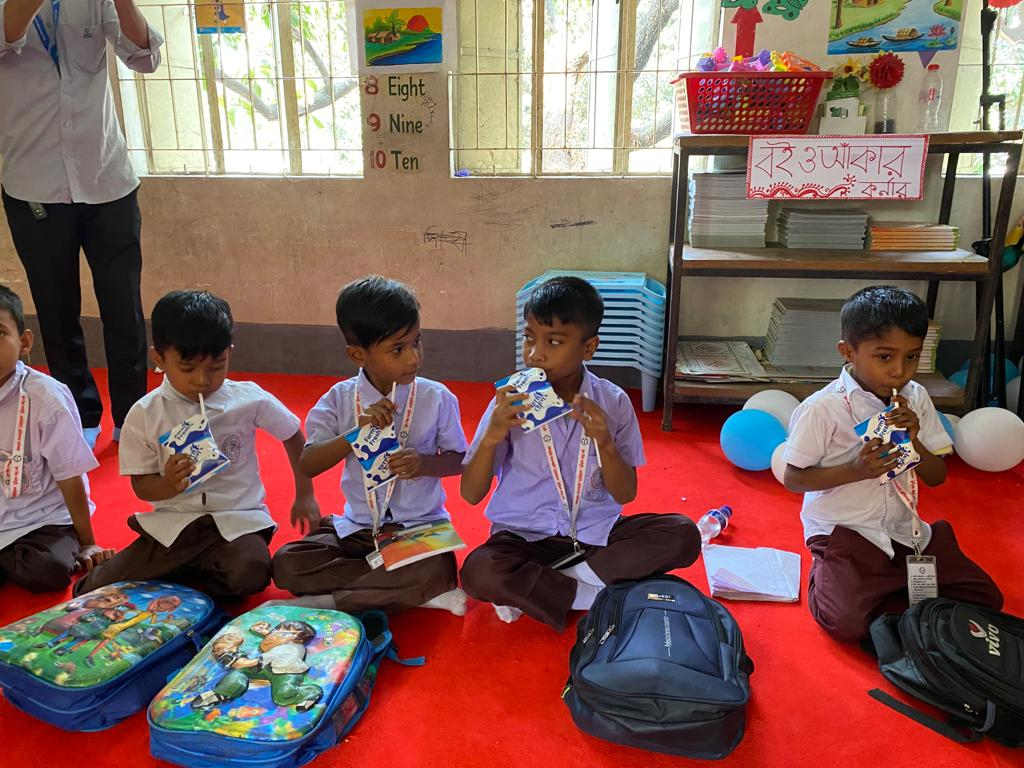

New School Milk Programme in Bangladesh aims to improve children’s health and school attendance

Ongoing initiatives to address the challenge in Bangladesh – childhood malnutrition and lack of formal milk collection.....

The smarter lunchrooms movement of California

Creating sustainable, research-based practices in the lunchrooms that guide students toward smarter choices in the school cafeteria.....

Peru’s school nutrition program

Preserving culture with innovative product and package design

UK School Milk Schemes

Supporting healthy eating habits and good nutritional health in children from an early age

Danish School Milk Scheme

Creating healthy eating and drinking habits for children through a voluntary school milk programme

Addressing childhood malnutrition in Sri Lanka

New school milk program in Sri Lanka also promotes food safety and recycling

Stratégie Nationale de Nutrition (National Nutrition Strategy)

The programme aims to promote children’s physical and mental well-being with a focus on nutritional health throughout the life cycle....

Burundi’s growing school food program

A new program to improve children's nutrition and school attendance

Enhancing child health in Russia through school milk

Promoting milk consumption and improving health in Russia

School milk helps increases enrolment rates in Kenya

Improving school attendance and nutrition through school milk programs

GiftMilk, a School Milk Programme in India

GiftMilk school milk program in India: providing nutrition support to children, helping eradicate malnutrition.....

Land O Lakes – Case study examples

Dairy Council of California launched Let’s Eat Healthy, a movement that brings together multisector stakeholders to coordinate, collaborate and co-c....

Rebate Program, Student Nutrition Ontario, Canada

Providing ongoing funding to ensure all Ontario children have equal opportunity to access milk

Elementary School Milk Program, Ontario, Canada

Supporting healthy meals in schools since 1986

MAFRA School Milk Program, Republic of Korea

Providing nutritious dairy products to students across the country since 1981

Swiss milk school milk program

'Break-time milk day' makes children and teachers aware of the importance of milk as a healthy breaktime snack.....

Contributing to the good health and nutrition of school children around the world

Related reports & publications

Related news & insights.

New President for International Dairy Federation

Piercristiano Brazzale (pictured), has today (2 November) been elected President of the International Dairy Federation (IDF).....

Focus On Sustainability At World Dairy Summit

The IDF press conference on 8 November will focus on how the dairy industry is committed to producing safe and nutritious products sustainably. A....

Get in touch

[email protected]

Customer service, quick links.

Global Dairy Expertise Since 1903

International Dairy Federation AISBL, 70/B, Boulevard Auguste Reyers, 1030 Brussels, Belgium

© 2024 International Dairy Federation. All rights reserved.

Privacy Overview

Lca verification framework.

- Knowledge library

Dairy farming case studies

When you want to make improvements on your farm, it can help to understand how other farmers approach similar challenges..

Applying industry guidance is a great start, but sometimes you need to read practical examples from other dairy farms.

Browse our case studies to learn how dairy farmers have made changes on their farms, it could save you time and money.

Breeding and genetics

- Wil Armitage turned his back on high production in favour of breeding for profit

- Dylan Harries focus on our spring calving index has driven profitability and achieved a top 5 percent genetic merit score

- David Cotton achieves an impressive herd replacement rate of 19%, placing him the top 5% of performers

- Andrew Gilman has been optimising age at first calving in his AYR herd

- Genomic testing and a tailored approach to breeding, has lifted Willie Baillie's herd genetic merit into the top 15% across the UK

Explore our breeding and genetics guidance

Calf and youngstock management

- Monthly weighing heifers helped Richard Evans bring down the average age of calving by nine months

- Marc Evans reduced pneumonia cases and improved health in his youngstock

- Andrew Wallis and Tony White implemented changes to boost heifer growth rates and reduce age at first calving

- Sharon and Guy Hawken saw higher daily liveweight gains and earlier-calving replacements by focusing on training and development

More about dairy calf management

Dairy cow diseases

- Identifying trace element deficiencies by blood testing helped Tom Bletcher reduce his stillborn rate from 8% to 2%

- Quarterly testing for Johne’s helped Rheinallt Harries identify infected cows and control the spread

Learn about diseases affecting dairy cows

Feeding and nutrition

- Reducing intervals between silage cuts has helped strategic dairy farmers Tony and Michael Ball reduce feed costs

- Jonny Crickmore cut concentrates, saving £30,000 on bought-in feed

- Willie Baillie reducing sorting by soaking concentrates overnight and saw milk yields increase by 1.5 litres per cow

Improve dairy cow nutrition

- Dan Burdett reduced his autumn calving block from 12 weeks to six weeks

- Jim Kirk lifted pregnancy rates across his herd from 20% to an impressive 25%.

Learn about fertility in dairy cows

Grass & forage management

- Read how George Wade increased milk from forage to 5,000 litres on his autumn calving farm

- David Merrett discusses why he decided to start cut and carry and the impact on his farm

Make the most of grass and forage

- Routinely mobility scoring helped Rhys Davies reduce lameness across his herd and identify replacements for future breeding

- Regular mobility scoring helped Robin Thomas reduce lameness cases by 29%

More about reducing lameness in your cows

- All year round calver Willie Baillie halved the number of mastitis on his farm

- Austin Russell reduced mastitis cases to 10 per 100 cows and increased yields by 2,000 litres

- Chris Mossman achieved significantly fewer mastitis incidences during the dry period and no cases during lactation

How to address mastitis issues in your herd

Milk production

- How Joe Carter's Holstein herd achieves an impressive daily lifetime yield of 20.4 litres

You might also be interested in:

Dairy online events and webinar archive

Discover our podcasts

Dairy homepage

© Agriculture and Horticulture Development Board 2024 | All Rights Reserved

Agriculture and Horticulture Development Board, Middlemarch Business Park, Siskin Parkway East, Coventry, CV3 4PE

IMAGES

COMMENTS

Case studies about dairy processors using equipment and ingredients. Articles; Files; ... For more than 60 years, Batavia, N.Y.-based O-At-Ka Milk Products has co-packed dairy-based products. One of O-At-Ka's bright spots has been the growing demand for co-packed ready-to-drink (RTD) beverages such as milk-based coffees, teas, energy drinks ...

value-added dairy product enterprises. This could be a promising strategy: though fluid milk consumption in the United States has fallen, consumption of value-added dairy products like yogurt and cheese has risen (Figure 2). Still, adding a value-added enterprise to a traditional Pennsylvania dairy is a big investment, and a significant risk.

Creating dairy products that address the nutritional needs of this group will be critical for growth in developed markets such as the European Union and the United States. ... Case study: Halo Top. Los Angeles-based Halo Top Creamery, which was founded in 2011, has garnered a loyal customer base by developing ice-cream products with a unique ...

The objective of this study was (1) to analyze the product image of plant milk and cow milk and (2) to compare the motivational structure behind the consumption of both product categories.

Economics of Dairy Products: A Case Study. 89. Contributory ma rgin was highest of Rs.33.84per kg where total fixed cost was . Rs.64,620.54 and average variable cost and selling price were Rs.20. ...

This e-book highlights five influential trends in the dairy case: •Clean label •Organic •Functional ingredients •Grass-fed products •Plant-based dairy alternatives These trends are closely interrelated, and they cross over a number of dynamic . categories, including cheese, ice cream, yogurt, and coffee creamers. This e-book

Case Studies in Dairy Processing Innovation. The dairy industry has long been a cornerstone of agricultural production worldwide, providing essential nutrients through a variety of products such as milk, cheese, yogurt, and butter. However, as global demand increases and environmental concerns grow, the sector has been under pressure to innovate.

Therefore, in this dairy product case study, green wa-ter consumed through pasture evapotranspiration has not been included in the inventory. The pasture-based agricultural system produces more drainage and stream flow than the natural forested ecosystem it long ago replaced (Rost et al., 2008). In addition, emissions to

In collaboration with experts from around the world, we have compiled a series of case studies that focus on practical experiences of developing and implementing school milk programs. Where possible, these case studies include shareable resources. ... Providing nutritious dairy products to students across the country since 1981. Read More.

UK monthly dairy product production UK milk flow diagram Milk Forecasting Forum EU milk deliveries (incl. organic) ... Applying industry guidance is a great start, but sometimes you need to read practical examples from other dairy farms. Browse our case studies to learn how dairy farmers have made changes on their farms, it could save you time ...